07 Feb 24

Insight

Global Equities

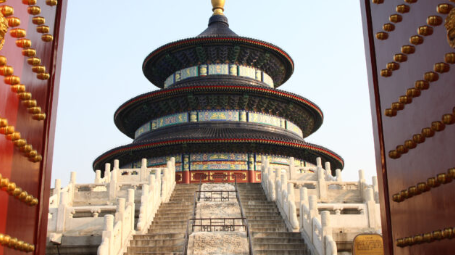

2024 Outlook: An inflection point for Emerging Markets

Welcome to 2024, the Year of the Dragon in the Chinese Zodiac. We believe the fundamentals are in place for emerging markets (EM) to outperform developed economies (DM) in the coming year. Many EM central banks, with a few exceptions, were first to react to combat inflation by shifting monetary policy and tighten financial conditions. As a result, many EMs were the first economies to loosen monetary policies in 2023 which will support growth in 2024.

30 Jan 24

Insight

Fixed Income

Key Themes for 2024: Fixed Income

Ardea Investment Management is a specialist relative value investor, focusing on non-directional opportunities within the global fixed income market. Unlike more traditional fixed income mangers, our investment process seeks to identify and exploit mispricing between assets with similar risk characteristics and does not rely on forecasts for the direction of interest rates or other macroeconomic variables to generate performance.

24 Jan 24

Insight

Fixed Income

Pure Relative Value: The Third Lever of Fixed Income

“In a world that is constantly changing, there is no one subject or set of subjects that will serve you for the foreseeable future, let alone for the rest of your life.” So said the American author, John Naisbitt, whose analysis of social trends led to predictions regarding automation in the workplace, globalisation and even the rise of artificial intelligence.

19 Jan 24

Insight

Alternatives

Preserving Natural Capital by Investing in Sustainable Infrastructure

Pressure to meet environmental metrics and reporting requirements has increased for institutional investors. Investing in natural capital offers a direct pathway for creating a positive environmental impact. However, the risk and return profile for these investments is still uncertain; many are sceptical of strategies that rely heavily on under-developed nature-based credit markets that qualify public good and negative externalities, i.e. biodiversity and carbon, as tradable units.

Investing in sustainable infrastructure assets provides the benefits associated with investing in nature without the risks. Read more to find out how to create a positive environmental impact with the comfort of investing in a traditional asset class.

15 Jan 24

Insight

Global Equities

Why Bother Investing in China?

The investment philosophy of Ox Capital is to buy champion businesses of the future when valuations are depressed. Typically, reason for the negativity is obvious. Our job, as long-term investors, is to look past short-term disruptions, and determine if the businesses possess strong economic moat which enable them to become champion companies in the future.

10 Jan 24

Insight

Alternatives

The Mining Industry: How to fuel the green energy supply chain sustainably

The green transition depends on essential mined materials, however, mining is a linear, extractive industry that consumes a great deal of energy and pollutes local ecosystems. ‘Greening’ production is essential to reducing heavy industry’s environmental impact especially as we accelerate the transition towards a more climate-friendly economy.

Co-locating appropriate renewable energy and water treatment assets on new and existing sites can achieve waste reduction, circular production and sustainable exploration.

12 Dec 23

Insight

Fixed Income

ESG in 10 -Episode 14: Why Europe is the region leading Sovereign Green Bond issuance, with Ardea

Charlotte O'Meara is joined by Gillian Jago, Senior Trader at Ardea Investment Management, to explore the dominance of Europe in sovereign green bond issuance amid a global slowdown.

11 Dec 23

Insight

Fixed Income

What this bond investor is watching most closely into 2024

Ardea Investment Management's Gopi Karunakaran explains how he spots opportunity and discusses the big conflict in central bank policy now.

28 Nov 23

Insight

Fixed Income

ESG in 10 -Episode 13: Navigating the Landscape of ESG in Asset Backed Securities, with Challenger Investment Management (CIM)

Delve into the challenges and advancements of integrating ESG considerations in Asset Backed Securities (ABS).