Correlation and How to Think About Diversifying Alternatives

Achieving diversification and uncorrelated returns are a common objective when constructing investment portfolios. Understanding what those terms really mean is essential to properly appreciate how alternative investments can contribute to robust long-term portfolios.

This article will explore how correlation works and the diversification benefits delivered by low correlation. We demonstrate how even small changes in correlation between assets can have a significant impact on portfolio performance. We also highlight the potential challenges when determining the correlation between assets and the key factors investors should consider in order to maximise the benefits of uncorrelated investments.

What is correlation?

Correlation is a statistical measure of the relationship between the returns of two investments (rather than price levels). It ranges from -1 to +1. Investments with high correlation tend to move in the same direction at the same time, while investments with little or no correlation tend to move independently of each other. Negatively correlated investments tend to move in opposite directions.

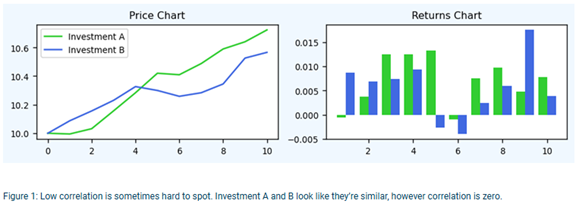

Importantly, two investments that both deliver positive long-term returns can nevertheless exhibit zero or even negative correlation. Conversely, investments that appear to move in opposite directions over time can be positively correlated. For example, daily price movements may show a very different relationship from the point to point one-year return.

In figure 1, at first glance it may appear that the two investments shown in the left-hand chart below are positively correlated. After all, for the period shown, both have increased by about the same amount. Looking at the daily returns in the chart on the right, we can see that most days the two investments do indeed move up together, however, on some days they move in opposite directions. Counterintuitively, the correlation of these two strategies turns out to be zero. An important implication is that investors can derive diversification benefits from two investments that both go up over time.

It’s also important to note that statistically high correlation does not imply causation. Just because two return series are highly correlated does not mean one necessarily causes the other to move. As a result, correlation can and does change over time.

Furthermore, correlation tells us whether investments move together, but not the magnitude of the moves. Two investments may be highly correlated but exhibit very different-sized gains or losses.

In summary:

- Correlation measures the relationship between the returns of two investments.

- Two investments that move in the same direction over time can be uncorrelated and two investments that move in opposite directions over time can be positively correlated.

- Correlation can change over time.

- Correlation can’t tell us how much one investment will move for a given move in another.

Why does correlation matter?

By combining uncorrelated investments, we can construct portfolios with lower risk and/or higher returns. This is the power of diversification. The lower the correlation between assets, the greater the potential benefit. This is where alternatives come in – no other asset class offers the same variety and breadth of uncorrelated investments as the universe of alternative investments.

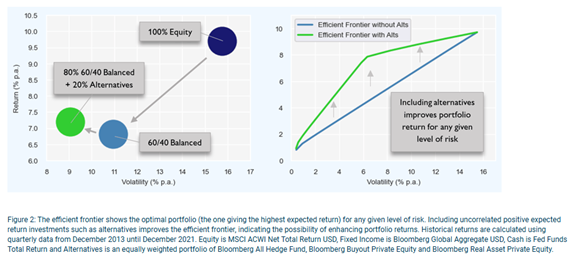

This idea is often illustrated using the Markowitz Efficient Frontier1, which shows the combinations of investments that deliver the highest expected return for a given level of risk. Adding investments with positive expected returns and low correlation can improve a portfolio’s position on this risk–return spectrum, allowing investors to achieve better outcomes without necessarily taking on more risk.

A simple illustration

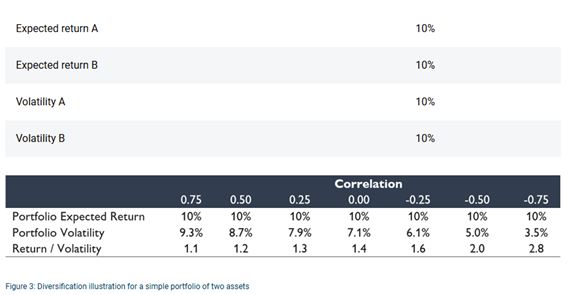

To see why uncorrelated assets produce better portfolios, consider two investments, A and B. Both are expected to return 10% per year and each has volatility of 10%.

Figure 3 shows that when these investments are highly correlated, combining them does little to reduce portfolio risk. However, when correlation is low or even negative, portfolio volatility drops to levels far below that of either A or B individually, even though expected returns remain the same. This leads to higher risk adjusted returns – the portfolio earns the same return with less volatility.

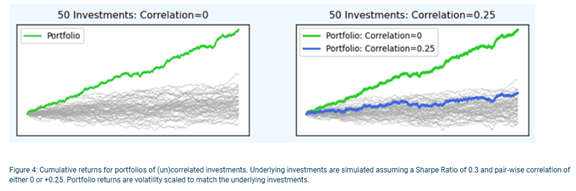

The effect becomes even more powerful in larger diversified portfolios. Consider an equally weighted portfolio of 50 completely uncorrelated investments, all with the same ex-ante expected return and ex-ante volatility and a modestly positive Sharpe Ratio2 of 0.3. The portfolio returns are shown by the green line on the left-hand chart, and the Sharpe Ratio is now 1.94, a significant improvement on any individual investment. However, even a small increases in correlation can significantly dilute these benefits. If these 50 investments now have a pair-wise correlation of 0.25 (still a relatively low correlation), the cumulative portfolio return becomes dramatically lower than when correlation was zero, as shown by the blue line in the right-hand chart.

While the above is a contrived example from a simulation, it illustrates just how powerful the combination of uncorrelated investments can be. This is where alternatives have the potential to play such an important role in investment portfolios.

In practice, it is extremely difficult to find large numbers of investments that are truly uncorrelated at all times. However, each additional uncorrelated investment introduced into a portfolio increases the potential diversification benefits for the portfolio. Alternative investments are often uncorrelated not only to traditional assets like equities and bonds, but also to each other, making a rich hunting ground for investors seeking to maximise the power of diversification.

There is, however, an important caveat. Just as low or negative correlation enhances diversification, even small changes in correlation can undermine it, sometimes quickly and unexpectedly.

What factors affect correlation?

Correlation can increase during periods of market stress, economic shocks or major shifts in monetary policy. Events such as the COVID market sell off in early 2020 saw correlations spike as many assets moved sharply lower at the same time. Even if only temporary, this can have a devastating impact on portfolios if previously uncorrelated investments all move in the same direction at the same time.

The experience of 2022 provided another stark example. Rising interest rates negatively affected both equities and bonds, causing the traditional 60/40 portfolio to suffer unusually large losses. Assets that investors expected to diversify one another instead moved together.

Understanding the common drivers of returns is therefore critical when thinking about how correlation might change. When many investments rely on similar economic factors, such as low interest rates, correlation can rise sharply when those conditions change, as we saw in 2022.

Some investors attempt to anticipate these shifts and rebalance portfolios accordingly. However, this can be difficult, so alternative investments that are less susceptible to correlation changes can be useful as 'anchor' diversifiers in a portfolio.

The challenges of measuring correlation

While uncorrelated investments can improve portfolio diversification and resilience, measuring correlation is not straightforward. There is no single measure to determine “true” correlation.

Investors need to consider:

- The time period used (daily, monthly, quarterly data)

- Whether correlation is stable or varies significantly over time

- When correlation tends to increase, especially during market stress

- Whether diversification is lost precisely when it is needed most

Useful techniques include examining rolling correlations, analysing how investments behave during market downturns and monitoring whether regime changes have altered the relationship between two investments.

It’s also worth remembering that correlation is only one part of the investment decision. Some investments may be attractive because of their risk/return profiles, even if diversification benefits are modest.

Understanding the role of alternatives in diversification

While investors often think about alternative investments as a single category, they can play very different roles within a portfolio. Broadly, alternatives can be grouped into three types based on their primary objective: growth alternatives, which aim to enhance overall portfolio returns; diversifying alternatives, which seek to improve risk adjusted returns by delivering low or uncorrelated performance; and defensive alternatives, which are designed to provide an explicit buffer during periods of market stress. Understanding these distinctions is critical, as the value an alternative investment brings depends not just on its standalone return, but on how it interacts with the rest of the portfolio.

Correlation and diversification are particularly central to the second category of diversifying alternatives. Investments with low correlation can materially improve portfolio outcomes by reducing volatility without sacrificing expected returns. Diversifying alternatives can therefore allow investors to achieve better risk adjusted returns rather than simply higher absolute returns, improving the efficiency and resilience of the portfolio as a whole. In this sense, alternatives that consistently deliver diversification benefits can be among the most valuable long term building blocks in a well constructed investment portfolio.

Final thoughts

Correlation measures how investment returns move relative to one another, but it is not fixed and cannot be relied upon to remain stable. Because correlation is based on historical data, there is no guarantee that it won’t change in the future.

That said, portfolios constructed with investments with low correlation can deliver higher returns for a given level of risk than those with more highly correlated investments. Correlation can therefore be an essential part of assessing any potential investment and is of particular importance when considering alternative investments.

A solid understanding of correlation, its applications and limitations allows investors to unlock the power of diversification. While correlations can change, alternative investments that deliver consistently low correlation to traditional assets can be particularly valuable in building more robust, resilient portfolios.

1Markowitz, H.M. (March 1952). “Portfolio Selection”. The Journal of Finance.

2The Sharpe Ratio is a commonly used metric which is calculated as the ratio of the excess return to the volatility of an investment. It can be interpreted as a measure of the return per unit of risk.