12 Sep 25

Insight

Fixed Income

Solvency II and Derivatives - Part 2

As a firm specialising in managing pure relative value strategies, where derivatives play a central role, we are keen to open the conversation around how these instruments can be used effectively and prudently within the constraints of Solvency II (SII) through a short series of papers. In this second paper, we look closely at the Prudent Person Principle and employing derivatives in the context of Efficient Portfolio Management (EPM).

23 Jul 25

Insight

Alternatives

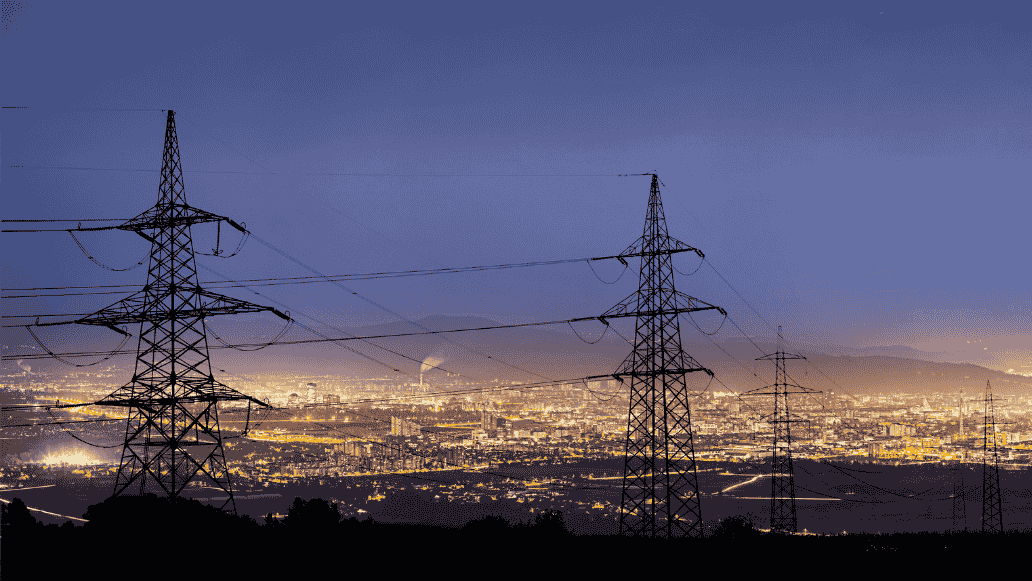

The Case for Infrastructure

As the US economy enters the second half of 2025, institutional investors are navigating a particularly nuanced macro environment.

04 Jul 25

Insight

Global Equities

Ox on the Ground: Vietnam’s Accelerating Transformation

Vietnam is rapidly positioning itself as a leading growth market in Asia, fuelled by sweeping policy reforms, unprecedented infrastructure investment, and a young, digitally driven population. During our recent visit to Ho Chi Minh City, the optimism was palpable - policy shifts are unlocking private sector momentum, modernising industries, and fuelling a new wave of growth.

03 Jul 25

Insight

Alternatives

Proterra Asia makes first investment in Laos with blueberry venture

Proterra Investment Partners Asia (“Proterra Asia”), has made its first investment in Laos, through Proterra Asia Food Fund 3 (“PAFF3”), backing a new blueberry cultivation project in Paksong.

24 Jun 25

Insight

Fixed Income

Solvency II and Derivatives - Part 1

Over the next few months, we’ll be releasing a short series of papers exploring how Solvency II (SII) applies to the use of derivatives within a pure relative value investment strategy. This first paper lays the groundwork for the series by outlining how we understand the core principles of SII as they relate to derivatives in a pure RV context.

11 Jun 25

Insight

Alternatives

Proterra Asia invests in Thailand’s largest edamame processor, LACO, to support international growth

Proterra Investment Partners Asia (“Proterra Asia”), has made its largest investment to date through its Proterra Asia Food Fund 3 (“PAFF3”) in Lanna Agro Industry Co., Ltd. (“LACO”), Thailand’s leading producer and exporter of frozen edamame.

03 Jun 25

Insight

Alternatives

Turning a Time Zone Constraint into a Truly Diversified Systematic Portfolio

In an interview with HedgeNordic, Marco Barchmann and Jerome Yim, co-founders of Spectrum Systematic Alpha, outlined their innovative approach to delivering consistent, uncorrelated returns through a multi-strategy, cross-asset systematic portfolio.

21 May 25

Insight

Fixed Income

Lessons from Liberation Day: Is now the right time to consider diversifying into securitised credit?

Given recent market volatility and the downside risks facing credit spreads, investors are increasingly questioning the resilience of traditional fixed income allocations.

08 May 25

Insight

Alternatives

Navigating the Nexus: Macroeconomics and Infrastructure Investments

In our latest comprehensive analysis, we explore the significant impact of macroeconomic trends on the stock market, with a particular focus on the infrastructure stocks.