11 Aug 25

Insight

Alternatives

Defined Benefit de-risking

In the first in our Defined Benefit Insights series, Meher Edibam, Director, Institutional Client Solutions discusses the current trend towards global Defined Benefit de-risking and how, despite having a smaller DB market, we’re experiencing a similar trend.

11 Aug 25

Insight

Alternatives

Correlation and the power of diversification

In ‘An introduction to alternatives investing’ we defined alternatives as investments that deliver uncorrelated returns. The terms 'uncorrelated returns' and 'diversification' are related and are a common objective when constructing investment portfolios. Understanding what those terms really mean is essential to properly appreciate how alternative investments can contribute to robust long-term portfolios.

11 Aug 25

Insight

Alternatives

Giving members the best outcomes

All super funds want to give their members the best outcome in retirement with what they’ve got. But what challenges are there to achieve this, and how can they be overcome? Director, Institutional Client Solutions, Stephan Richartz explains what options there are, and what funds can do to achieve the best outcomes for their members.

23 Jul 25

Insight

Alternatives

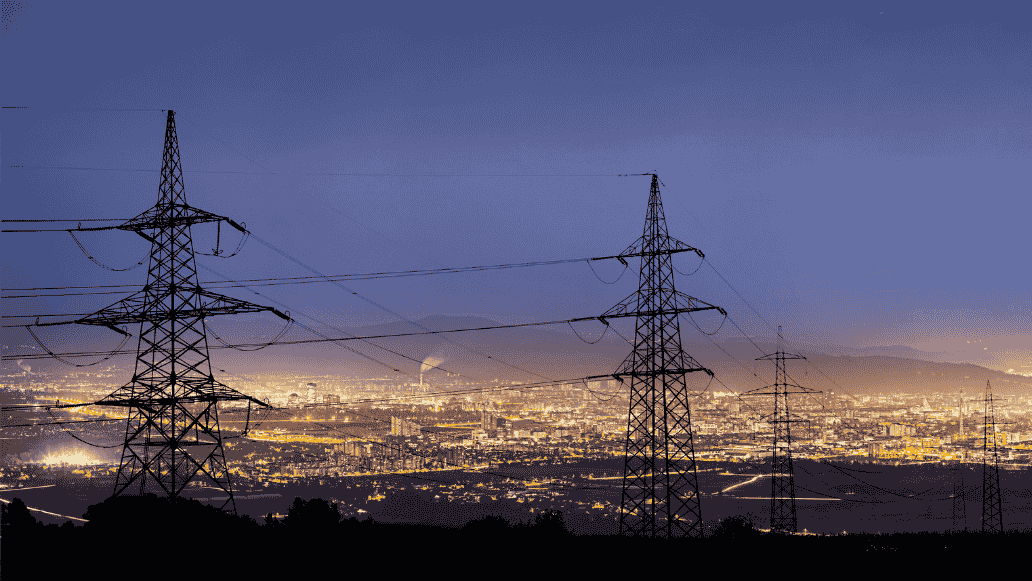

The Case for Infrastructure

As the US economy enters the second half of 2025, institutional investors are navigating a particularly nuanced macro environment.

04 Jul 25

Insight

Global Equities

Ox on the Ground: Vietnam’s Accelerating Transformation

Vietnam is rapidly positioning itself as a leading growth market in Asia, fuelled by sweeping policy reforms, unprecedented infrastructure investment, and a young, digitally driven population. During our recent visit to Ho Chi Minh City, the optimism was palpable - policy shifts are unlocking private sector momentum, modernising industries, and fuelling a new wave of growth.

03 Jul 25

Insight

Alternatives

Proterra Asia makes first investment in Laos with blueberry venture

Proterra Investment Partners Asia (“Proterra Asia”), has made its first investment in Laos, through Proterra Asia Food Fund 3 (“PAFF3”), backing a new blueberry cultivation project in Paksong.

24 Jun 25

Insight

Fixed Income

Solvency II and Derivatives - Part 1

Over the next few months, we’ll be releasing a short series of papers exploring how Solvency II (SII) applies to the use of derivatives within a pure relative value investment strategy. This first paper lays the groundwork for the series by outlining how we understand the core principles of SII as they relate to derivatives in a pure RV context.

11 Jun 25

Insight

Alternatives

Proterra Asia invests in Thailand’s largest edamame processor, LACO, to support international growth

Proterra Investment Partners Asia (“Proterra Asia”), has made its largest investment to date through its Proterra Asia Food Fund 3 (“PAFF3”) in Lanna Agro Industry Co., Ltd. (“LACO”), Thailand’s leading producer and exporter of frozen edamame.

21 May 25

Insight

Fixed Income

Lessons from Liberation Day: Is now the right time to consider diversifying into securitised credit?

Given recent market volatility and the downside risks facing credit spreads, investors are increasingly questioning the resilience of traditional fixed income allocations.