Why Manager Selection Matters in Alternative Investments

The alternatives space encompasses asset classes that fall outside traditional public equities or bonds. It includes private equity, venture capital, private credit, real estate, infrastructure and hedge funds. These asset classes allow investors to diversify portfolios and access new sources of alpha through strategies and opportunities that are not available in traditional markets. For example, private equity and venture capital allow investors to participate in the growth of private companies, while private credit can offer higher returns from diverse borrowers. Hedge funds can further diversify portfolios and deliver returns that are less correlated with traditional stocks and bonds. Furthermore, alternatives often operate in less efficient environments, where information asymmetry, complexity, and illiquidity can create opportunities for skilled managers to generate outsized returns.

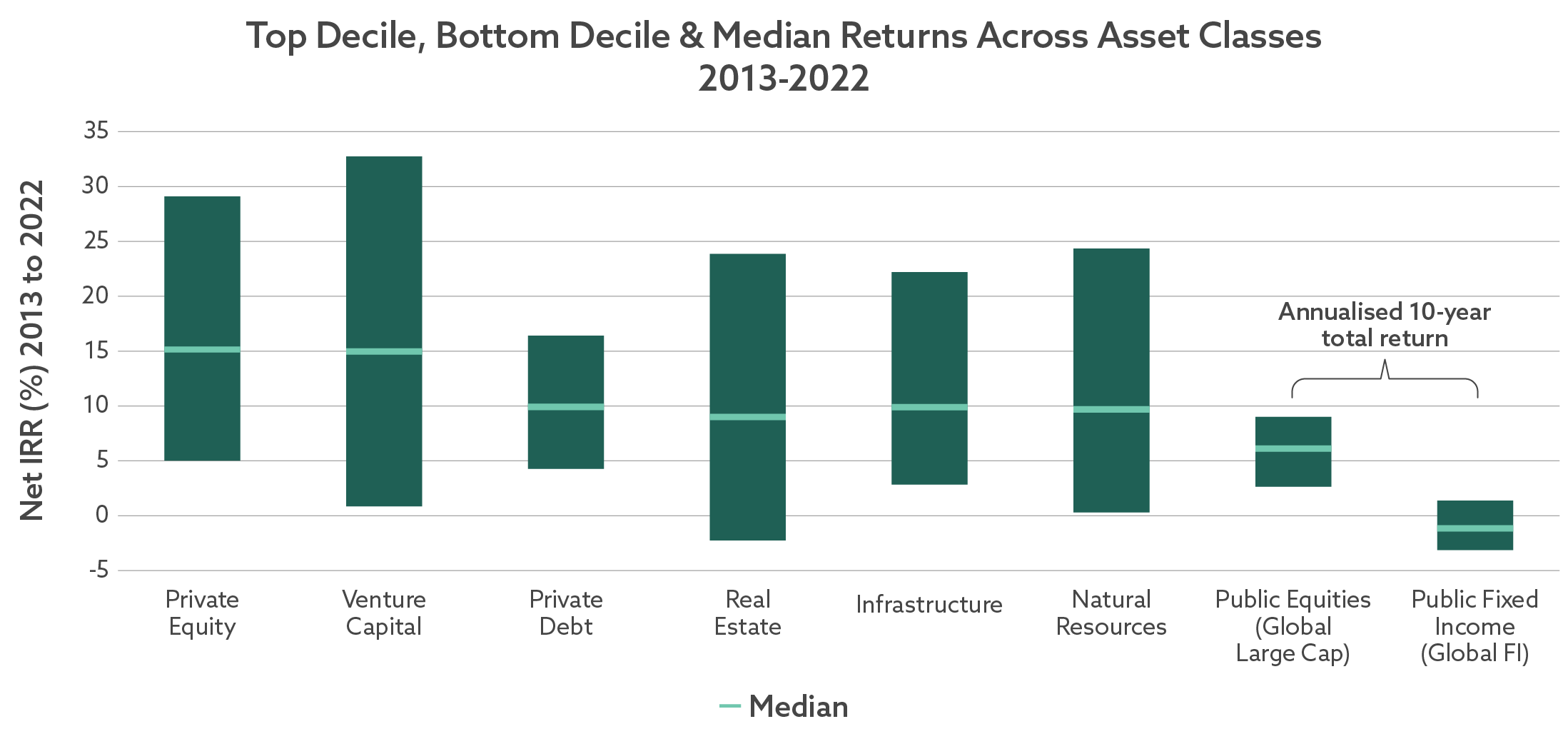

However, with these opportunities comes the critical challenge of manager selection. Performance dispersion across managers in alternative asset classes is significantly wider than in traditional strategies. This means that choosing the right manager makes a meaningful difference in return outcomes.

Performance Dispersion

While alternative investments can offer attractive returns, there is significant dispersion in the performance of different managers in this space. This means that simply investing in these asset classes is not enough to realise the benefits – identifying skilled managers is critical. Studies on the returns from private equity and venture capital funds, for example, show that top-quartile managers often outperform median or bottom-quartile managers by a wide margin.

Figure 1

Source: Preqin, Morningstar. Net IRRs calculated from the median IRR across global vintages from 2013-2022 in USD for each category (top decile, median and bottom decile) to represent typical asset class performance. Public equity returns are 10-year annualised returns from 2013-2022. Morningstar category used is “Global Equity Large Cap”, including obsolete strategies, in USD. Public fixed income returns are 10-year annualised returns from 2013-2022. Morningstar category used is “Global Fixed Income”, including obsolete strategies, in USD. Past performance is not a reliable indicator of future performance.

Figure 1 shows the top decile, bottom decile and median returns over a period of 10 years. It features net annualised internal rates of return (IRR) of different alternative asset classes as well as global public equities and public fixed income. The spread from the top decile to the median in private equity, venture capital, real estate, infrastructure and natural resources is significantly wider than public equities. Private debt returns are also much more widely dispersed than public fixed income returns. This demonstrates the broad return outcomes that are possible when investing in alternatives and highlights the importance of selecting a top manager to access the benefits.

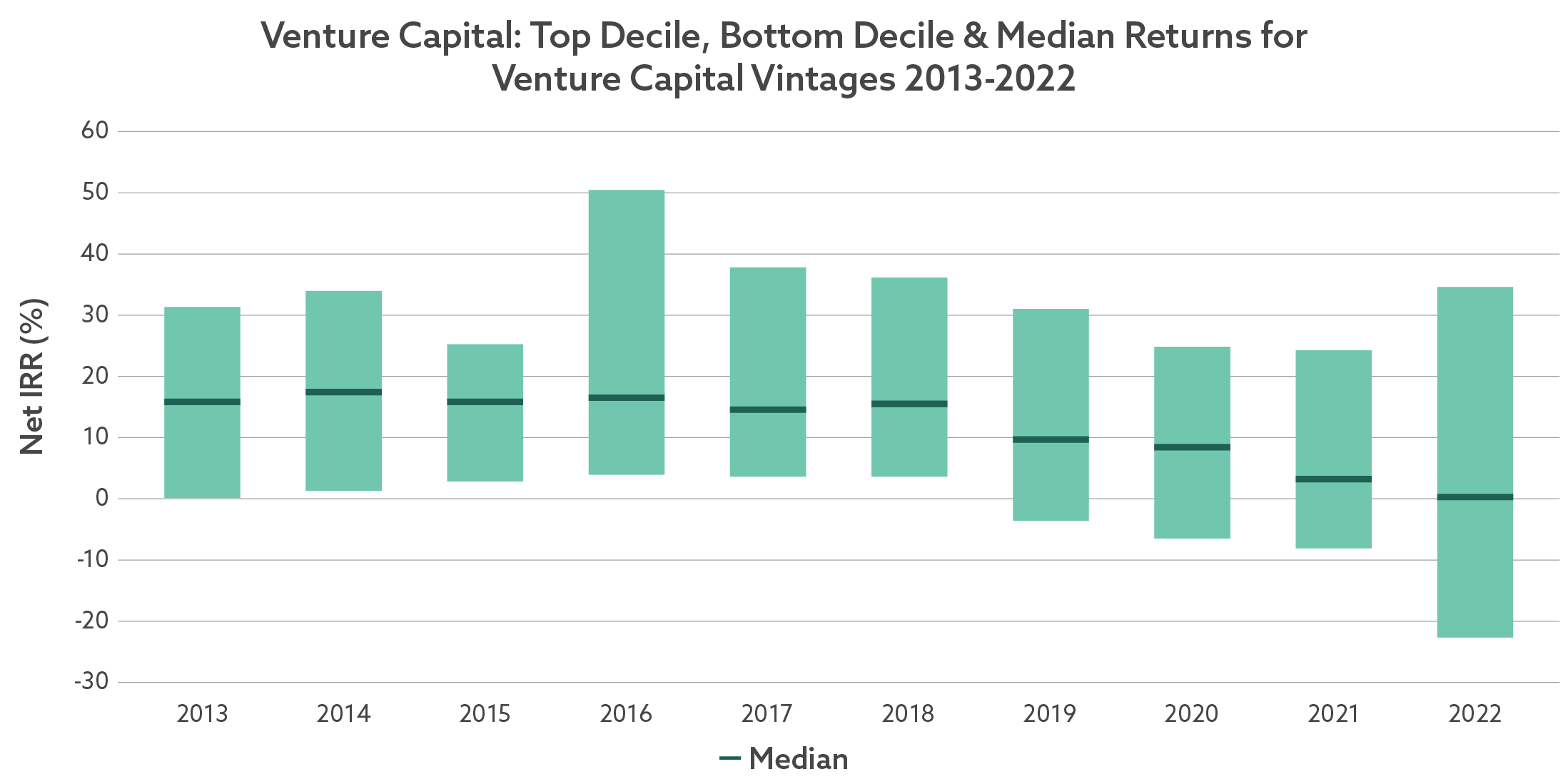

The persistence of this wide dispersion of performance across vintages is further demonstrated in figures 2 and 3 below which focus on private equity and venture capital.

Figure 2

Source: Preqin. Past performance is not a reliable indicator of future performance.

Figure 3

Source: Preqin. Past performance is not a reliable indicator of future performance.

Illiquidity & Complexity Premiums

Alternative assets often reward investors with an illiquidity premium for committing capital over longer periods. Beyond this, many alternatives markets are less efficient and more complex than traditional markets, which can be due to limited transparency, fewer participants or higher barriers to entry. These inefficiencies create opportunities for managers who have the expertise, networks and resources to unlock value. However, not all managers have the same capabilities, and it is essential for investors to identify skilled managers who can capitalise on the unique features of alternative assets.

Hedge Funds: Correlation is Key

While hedge funds generally deliver lower returns on average than equities, their main benefits come from reduced levels of volatility and low correlations to traditional assets. This makes them valuable for portfolio construction, but only if they behave as claimed. A hedge fund that demonstrates low correlation to traditional markets during normal times may still produce returns that are highly correlated during periods of market stress, failing to serve its intended purpose. It is crucial to select a truly uncorrelated product to ensure a hedge fund plays its role in a portfolio.

Addressing the manager selection challenge

How can one address the challenge of manager selection? Independent research and ratings groups can assess manager quality to help investors navigate the complex landscape. Many investors also diversify across multiple managers to reduce idiosyncratic risk and improve portfolio resilience. In addition, there are criteria upon which a manager can be assessed.

Specialised skillset

Alternative asset classes often involve greater complexity than traditional asset classes. This complexity can be an important source of additional alpha, but only if the manager has the expertise to navigate the space. A long-standing presence in the market and highly skilled team is key.

Track record of returns and correlations

A manager’s ability to deliver strong risk-adjusted returns through different market environments is critical. In alternatives, such as hedge funds, it's important to assess not just performance but also how the strategy behaves relative to other assets. If a fund claims low correlation to equities or bonds, verify this through historical data – has it truly delivered diversification when it mattered most?

Scale, brand presence and network

Alternative investing often has high barriers to entry as it deals in assets that are not widely owned or distributed, such as private market assets or specialised hedge fund strategies. Access is everything, so managers need to have sufficient scale, reputation and network to source deals and gain early insights on prospective investments, such as a potential short target for a hedge fund.

Best in class governance

Alternative assets are inherently less transparent than traditional assets, whether due to confidentiality in private deals or the need to protect the inner workings of hedge fund strategies. As a result, strong governance is paramount to manage potential conflicts of interest and ensure alignment with investor outcomes. An independent valuation process, robust risk management frameworks and transparent fee structures are some of the characteristics of good governance.

The wide dispersion in performance across alternative investment managers combined with the complexity and inefficiency of these markets means the choice of manager can significantly impact outcomes. Skilled managers have the potential to deliver attractive risk-adjusted returns and diversification that build more resilient portfolios. By considering a manager’s expertise, track record, scale and governance, investors can choose wisely and better position themselves to capture the many benefits of alternative investments.

This material has been prepared by Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante). The information in this material is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed may change as subsequent conditions vary. Neither of Fidante nor any of its respective related bodies corporate, associates and employees, shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the material or otherwise in connection with the material. It is intended to provide general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Fidante, its related bodies corporate, its directors and employees and associates of each may receive remuneration in respect of the financial services provided by Fidante.