Striking the right note: The Fed opts for policy continuity

Key takeaways:

- A moderating but still resilient economy has enabled the Federal Reserve (Fed) to hold off on rate cuts, allowing earlier restrictive initiatives to run their course.

- Although Fed Chairman Jerome Powell upgraded 2024 inflation and economic growth projections, his tone was less hawkish than some had anticipated after recent hotter-than-expected consumer price index readings.

- The combination of a soft landing and near-inevitable rate cuts presents an opportunity for investors to increase risk by modestly extending duration and seeking higher-quality issuance.

Compared to the last two Fed meetings – each requiring a generous helping of additional context to explain shifts in the projected policy path – this week’s meeting proved relatively uneventful. Investors should welcome this policy continuity as a sign that a soft landing is the likely endgame. This should go a long way toward giving investors the confidence to modestly increase risk across fixed income portfolios.

By the numbers

As expected, the Fed held its benchmark overnight lending rate steady, at a range of 5.25% to 5.50%. While this outcome was widely expected, the Summary of Economic Projections was highly anticipated, with many wanting to see how the Fed would account for recent inflation and retail sales data. After consumer prices surprised to the upside in January and February, some wondered whether the Fed would stick to their projected three 25 basis point cuts in 2024, and they did.

In acknowledging that the economy remains on sound footing – and perhaps more than expected at this stage – they raised their expectations for 2024 gross domestic product (GDP) growth from 1.4% to 2.1% and core inflation from 2.4% to 2.6%. With those upgrades, Fed officials may have been tempted to lower the number of expected 2024 rate cuts to two. However, growing softness in retail sales and the presumption that hotter-than-expected consumer prices were a function of the seasonality likely held policymakers at three. In a nod to continued economic resilience, however, voting members did reduce their expectations for 2025 rate cuts by one – now expecting the overnight rate to end that year at 3.9%.

Reinforcing the Fed’s expectation of a soft landing, Chairman Jerome Powell commented that demand for labour still exceeds supply. In a service-based economy like the U.S., one would expect labour market and wage pressures to weaken considerably for inflation and economic growth to move materially downward. With the employment backdrop still healthy – the December 2024 unemployment rate projection was revised downward from 4.1% to 4.0% – the Fed still enjoys the latitude of allowing restrictive policy rates to filter through the system. Worth watching are incipient signs that the labour market may be turning the corner. Job openings are 25% off their cycle peak, and voluntary separations (the quits rate) have also fallen back to Earth.

Adding the right kind of risk

We see this report as evidence that the wild ride that characterized global bond markets since the post-pandemic reopening may soon be over. Thanks to effective monetary policy, inflation is declining, and recession risk is low in many markets. In such jurisdictions, this scenario is favourable for riskier assets, including investment-grade corporate credits and equities. While a soft landing is most people’s base-case scenario, we are undeniably late in the policy cycle. At this stage, we believe quality is of paramount importance.

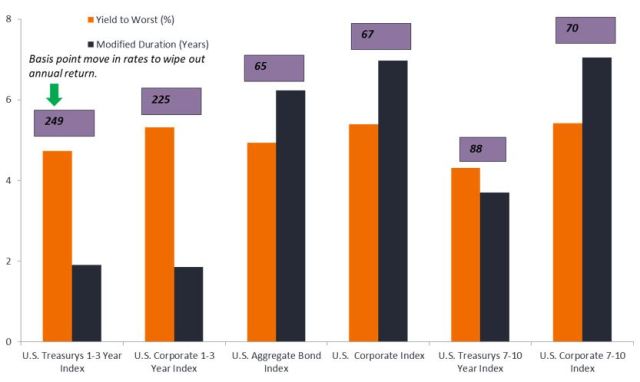

Yield to worst and modified duration of segments of the U.S. fixed income market

In contrast to much of the past decade-plus, the risk-return profile of bonds has reverted to historical norms.

Source: Bloomberg, as of 20 March 2024.

Consistent policy, at least recently, has narrowed the range of outcomes for both the global economy and financial markets. This should incentivize those holding large amounts of cash on the sidelines to consider increasing their allocations to riskier assets. Typically, the first stop in this reallocation is safer pockets of the market, including sovereigns and investment-grade corporates.

Modestly extending interest rate risk (or duration) should also be a consideration. Many investors have little to no duration exposure as they have opted to pile into money market funds, meaning they will have little upside exposure should rates decline. These investors would not have to do much to increase interest rate risk. Focusing on issuance within the one-to-three-year range is a destination worth considering, given the consensus view that the next move in policy rates in the U.S. and most other major markets is down. This could be particularly true for European bonds, as the currency bloc’s central bank may be forced to cut before many of its developed market peers.

In the U.S., the upwardly revised inflation and GDP estimates indicate that a downward move farther out along the yield curve could be more limited. Additional upside growth surprises could even see yields modestly rise. With policy rates at their cycle peak, we expect more stability on the front end of the curve, and though the expected early 2024 cuts have been delayed, their near inevitability means that shorter-dated tenors are positioned for capital appreciation as central banks move away from restrictive stances.

An eye toward the future

The Fed’s battle against inflation has gotten an assist from the supply side of the economy. Workers re-entering the labour force and supply chains sorting out bottlenecks have contributed to price pressures letting off steam. In time, the risk may swing from not enough to excess capacity. That is the point at which we believe dovish policy will be enacted.

However, the era of one-size-fits-all monetary policy is likely behind us. Going forward, countries will have to tailor future policy prescriptions to align with their unique macroeconomic situation.

Other risks remain. Geopolitical tensions remain high, with conflict impacting energy and agricultural flows. Additionally, a series of consequential elections will take place throughout the year. While uncertainty is not an investor’s friend, the resetting of bond yields back to their historical range means that, once again, a mix of sovereign bonds, high-quality corporates, and securitized products can serve as a diversifier to a broader portfolio in the event of a sell-off in riskier assets while at the same time potentially generating attractive levels of income.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.