Solvency II and Derivatives - Part 1

Part 1: Introduction

Over the next few months, we’ll be releasing a short series of papers exploring how Solvency II (SII) applies to the use of derivatives within a pure relative value investment strategy. This first paper lays the groundwork for the series by outlining how we understand the core principles of SII as they relate to derivatives in a pure RV context. As a firm specialising in managing pure RV strategies, where derivatives play a central role, our goal is to open the conversation around how these instruments can be used effectively and prudently within the constraints of SII.

We know there’s a wealth of regulatory and actuarial expertise in this space, and we hope this series sparks further discussion and shared insights.

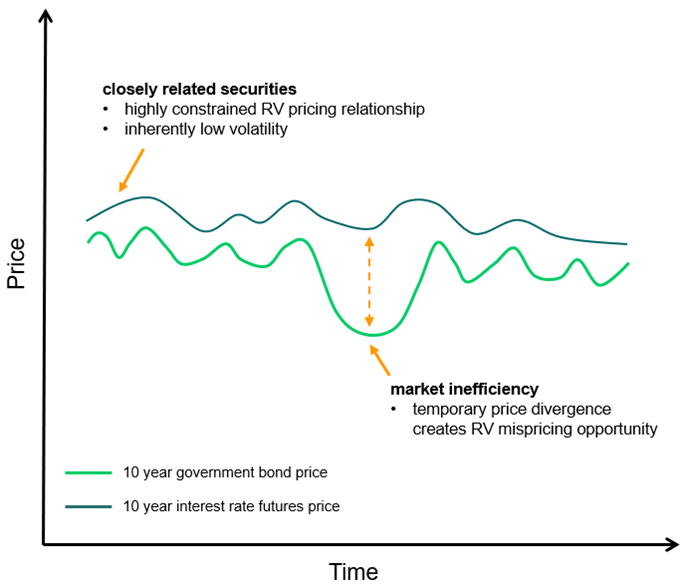

Historically, pure RV returns have shown little or no correlation with traditional asset classes like equities, government bonds, and corporate credit, making them a valuable source of diversification. The strategy’s reliance on liquid instruments also supports portfolio flexibility. Typically, the investment process identifies mis-pricings between closely related securities (for example, a 10-year bond and a 10-year futures contract in the same market), constructs trades to exploit these mis-pricings, and bundles them to build a relative value portfolio.

Once a market inefficiency is identified and a trade established, unwanted market risk is usually removed by taking an offsetting position using derivatives. This ability to isolate the targeted mispricing and strip out broader market exposure is one of the key strengths of a pure RV approach, and it relies heavily on derivatives.

Solvency II includes a range of safeguards around derivatives, allowing their use for hedging and efficient portfolio management, but with strict limits. For this reason, understanding how SII treats derivatives is essential. Over the coming months, we’ll dive deeper and provide relevant examples of SII’s application to derivatives in pure RV strategies.

Derivatives in pure RV strategies are used in two main ways:

1. Risk management

For a fixed income pure relative value approach, the strategy is implemented to be 'duration neutral'. To avoid interest rate duration exposure, the only way to manage risk is by the targeted and dynamic use of derivatives. This requires the micromanagement of duration exposures at the individual trade level, resulting in hundreds of offsetting derivative positions. This compares to a blunter use of derivative overlays to provide directional interest rate protection typical in most fixed income portfolios. A simplified example of what this mechanism looks like in practice is presented below, where a 10Y bond has a price divergence to a closely related 10Y interest rate future.

To capture this mispricing, the pure RV approach would involve buying the 10Y bond whilst at the same time selling the 10Y future. This results in two trades: a ‘long’ bond trade; and a ‘short’ futures trade, so that the duration of the short futures contract matches that of the bond. This structure, (long the physical bond, short the derivative) isolates the mispricing and removes the unwanted duration exposure from holding the bond.

2. Relative value implementation

The second role of derivatives in pure RV strategies is in implementation. Interest rate derivative markets also offer a broad range of highly flexible and liquid tools, for optimal implementation of RV strategies. This is because the universe of derivative instruments referencing different market interest rates at various time horizons is far larger and more diverse than the universe of bonds. Using this flexibility opens up opportunities to target a far wider pool of mis-pricings and market inefficiencies than would be possible with bonds alone.

How are derivatives treated under SII?

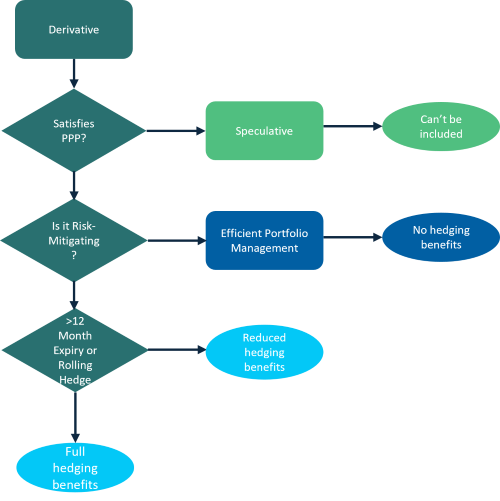

Derivatives within the framework of Solvency II can be classified into distinct categories, namely risk mitigating, efficient portfolio management, and speculative. These categories are mutually exclusive, and the classification process is explained in the flow chart depicted in Figure 1. Failing to meet the risk mitigating or efficient portfolio management criteria will impose limitations on the utilisation of the derivative. For example, if a derivative satisfies the Prudent Person Principle (PPP) but is not ‘risk mitigating’ then it is classified under the banner of Efficient Portfolio Management (EPM).

Figure 1 - Derivative classification under SII

We will explore the definitions of the Prudent Person Principle (PPP), Efficient Portfolio Management (EPM), and Risk Mitigating in more detail in future papers. Here, we’re simply highlighting that Solvency II distinguishes between these categories, and that this classification matters.

For illustrative purposes, if we assume the pure RV strategy satisfies the Prudent Person Principle (covered in the next paper), then, based on the characteristics outlined above, it could then fall into either the Risk Mitigating or EPM categories.

For example, where derivatives are used specifically to isolate mis-pricings between securities, resulting in a return profile that is negligibly correlated with market risk factors such as currency, duration, credit, or equity risk, this may qualify as mitigating market risk.

Alternatively, if derivatives are used to improve liquidity or provide protection via optionality, the strategy may fall under the EPM category. In both cases, if the overall risk is constrained and volatility remains low, the strategy would also meet the expectations of the Prudent Person Principle.

Conclusion

This paper sets the groundwork for how we interpret the treatment of derivatives under Solvency II, particularly in the context of strategies that aim to be market risk neutral. Using pure relative value as the lens, we’ve outlined how the rules might apply in practice, based on our reading of the framework.

Our interpretation is that, depending on how derivatives are used, a pure RV strategy could sit within either the risk mitigating or efficient portfolio management categories, so long as it aligns with the broader principles set out under SII (PPP).

We’ll continue to explore these classifications and the practical considerations they raise in the next papers in the series.

Important Information

This material has been prepared by Ardea Investment Management Pty Limited (Ardea) (ABN 50 132 902 722). Ardea is the holder of an Australian financial services licence AFSL 329 828 and is regulated under the laws of Australia.

This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.

This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither Ardea nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.