Outlook: Navigating Volatility with Conviction

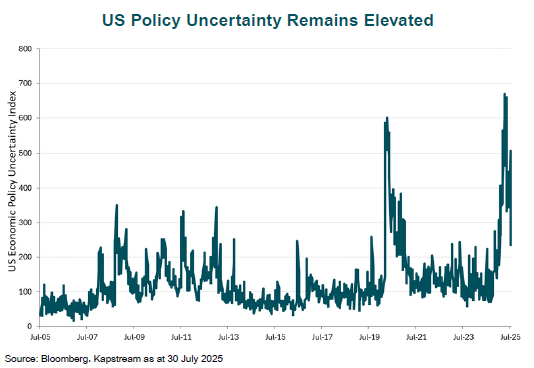

Our highest conviction view for the year ahead is that volatility will remain a defining feature of markets. While the current U.S. administration is broadly seen as pro-business and supportive of economic growth, certain policies, particularly tariffs, have proven to be inconsistently designed and implemented. As a result, headline risk remains elevated.

At present, the economic drag from tariffs appears largely offset by the stimulatory effects of tax cuts from the “Big, Beautiful Bill.” However, both are likely to contribute to upward pressure on inflation. The policy environment remains fluid and susceptible to rapid shifts, sometimes triggered by a single tweet. Against this backdrop, we maintain a constructive stance on risk, but anticipate intermittent bouts of volatility. Retaining some dry powder to capitalise on dislocations seems prudent, such as the brief widening in credit spreads seen in April.

While policy decisions may temporarily lift inflation, we expect it to continue moderating toward central bank targets, with official interest rates gradually normalising. Some regions are already near neutral, though this does not yet include the U.S. or Australia. We anticipate the Fed will resume its path toward neutral once tariff-related uncertainties subside. Similarly, the RBA appears to be a few rate cuts away from a neutral stance, likely proceeding at a measured pace of 25bps per quarter over the next twelve months. These expectations are largely reflected in current market pricing. Only in more adverse scenarios would we foresee a deeper or more aggressive global easing cycle.

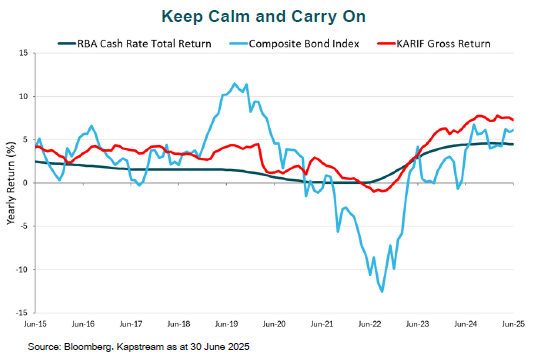

Our core fixed income strategy for the remainder of 2025 is to ‘keep calm and carry on.’ Credit spreads still offer attractive income, especially when combined with relatively high policy rates and therefore bond yields. Strategies focused on income generation and lower sensitivity to market volatility are likely to deliver more stable returns. The chart below shows how Kapstream’s flagship portfolio has regularly provided additional income above the cash rate, but with far less sensitivity to market movements over the cycle that comes from portfolios linked to longer-duration benchmarks such as the composite bond index. While longer-duration assets may outperform in a recessionary scenario where yields fall significantly, this scenario seems less likely with business-friendly fiscal policies in the US and elsewhere. Should the more likely benign economic scenarios eventuate, such funds are prone to heightened volatility without commensurate return potential. Maintaining liquidity also remains essential to seize opportunities during expected market volatility – locking up investments for extended terms may not allow sufficient flexibility to take advantage of the opportunities that are expected to arise.

Risks to our view include:

- Tariffs proving larger and more disruptive than expected, triggering a sharper slowdown and more aggressive monetary easing.

- A resurgence in inflation prompting central banks to maintain higher rates, undermining growth, earnings, sentiment, and bond prices.

- Escalating geopolitical tensions with the potential to materially impact global economic activity.

In this environment, active management and responsiveness to evolving conditions will be more critical than ever. If you would like to discuss how Kapstream’s products can assist in that regard, please reach out to us.

This material has been prepared by Kapstream Capital Pty Limited (ABN 19 122 076 117 AFSL 308870) (Kapstream). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any rate of return nor capital invested are guaranteed.