The One Decision that Matters Most in Alternatives

Investors and their advisers are increasingly turning to alternatives in the search for alpha. While adoption continues to grow, one decision matters above all else – picking the right investment manager.

Alternatives encompass a wide range of investment opportunities, from private equity and credit, to venture capital, real estate, infrastructure, and hedge funds. Once considered peripheral, alternatives are now firmly part of portfolios, allowing investors to access opportunities not available through traditional, public markets alone.

At Fidante, we spend a lot of time and effort understanding emerging investment trends and demand, not just focused on immediate opportunities but anticipating the years to come. Looking forward, one thing is clear: traditional 60/40 portfolios are structurally changing. As equity and bond market correlation increases, alternatives provide an attractive way for investors to diversify portfolios and access new sources of alpha.

Institutional investors have been leading the way and now we are seeing widespread adoption from advisers and sophisticated individuals. Our latest Fidante Adviser Markets Survey highlights this shift. Today, 77 per cent of advisers allocate up to 10 per cent of client portfolios to alternative assets. Infrastructure (21 per cent), private credit (17 per cent), and private equity (16 per cent) were the key beneficiaries of this trend. Looking forward, we anticipate this trend to only accelerate. More than a third of advisers surveyed (36 per cent) are planning to increase allocations to private credit and infrastructure.

In the face of ongoing share market volatility, global macroeconomic uncertainty, and interest rate unpredictability, defence and diversification are top of mind and a key driver of rising allocations to alternatives.

Performance dispersion makes manager selection critical

Alternative investments can deliver attractive returns, but performance varies widely between investment managers. This makes identifying skilled managers critical.

Liquid alternative funds, for example, use a wide array of strategies, including long/short equity, quantitative and global macro, which can be complex in nature. Managing this complexity is critical. Two liquid alternatives managers following the same stated strategy can deliver vastly different outcomes due to differences in trading skill, risk management, and operational execution.

While return dispersion exists across all asset classes, studies show it is far more pronounced in alternatives with top-quartile managers routinely outperforming median and bottom-quartile peers by a wide margin.

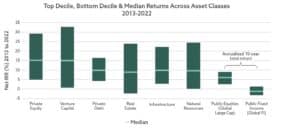

Figure 1

Source: Preqin, Morningstar. Net IRRs calculated from the median IRR across global vintages from 2013-2022 in USD for each category (top decile, median and bottom decile) to represent typical asset class performance. Public equity returns are 10-year annualised returns from 2013-2022. Morningstar category used is “Global Equity Large Cap”, including obsolete strategies, in USD. Public fixed income returns are 10-year annualised returns from 2013-2022. Morningstar category used is “Global Fixed Income”, including obsolete strategies, in USD. Past performance is not a reliable indicator of future performance.

Figure 1 highlights the top, median, and bottom decile returns across major alternative asset classes compared with global equities and fixed income over a 10-year period. The spread from the top decile to the median in private equity, venture capital, real estate, infrastructure, and natural resources is significantly wider than public equities.

Private debt returns are also much more widely dispersed than public fixed income returns. This demonstrates the broad return outcomes that are possible when investing in alternatives and highlights the importance of manager selection.

The persistence of this manager performance dispersion is also seen in private equity and venture capital (figures 2 and 3 below). In other words, returns are driven less by broad market exposure and more by the skill and discipline of the manager.

Figure 2

Source: Preqin. Past performance is not a reliable indicator of future performance.

Figure 3

Source: Preqin. Past performance is not a reliable indicator of future performance.

Navigating the manager selection challenge

Rightly, investors and advisers are exercising caution when exploring this asset class, balancing risks, such as liquidity, against the return premiums on offer. However, what the above data tells us is selecting the right active alternative manager is the most important factor to consider when increasing exposure to this growing asset class.

What goes without saying is that an investment manager must be of the highest quality and have a demonstrated track record of delivering high quality investment outcomes to their investors across market cycles. Scale also matters as alternative investing often has high barriers to entry. And given alternative assets are inherently less transparent, strong governance is paramount.

Investors should carefully assess the structure and resourcing of investment teams, ensuring they have sufficient size and depth of experience to manage complex portfolios. Alternative markets often demand highly specialised expertise, making team capability critical. Additionally, governance has become a focal point globally, underscoring the need for robust practices such as independent valuations, proper marking to market of assets, mitigating conflicts of interest, and adequately managing liquidity.

Realising the benefits

As investors seek to build more resilient, forward-looking portfolios, alternatives offer compelling benefits: diversification, uncorrelated alpha, and exposure to long-term structural themes. Attributes that are important complements to public market allocations. But realising these benefits relies on selecting managers with proven capability, strong governance, and the scale required to navigate complex, inefficient markets.

Alternatives are no longer “alternative”. They are a growing and increasingly important part of modern portfolio construction. With the right manager, investors can position themselves to capture the return potential available across this expanding universe of opportunities.

Author: Victor Rodriguez, Chief Executive of Funds Management, Challenger