Australian Equities 2026: The Year of Earnings, Expansion and Execution

If 2025 was defined by Resilience, Rates and Resources, we expect 2026 to be shaped by the three E’s: Earnings growth for the first time in 3 years driven by the resources sector, Expansion hopes that the earnings upgrades we are seeing in resources & financials broaden to other sectors in the market, and management Execution determines winners from losers. These themes frame our constructive outlook for Australian equities in the year ahead.

Reflecting on 2025: Resilience, Rates and Resources

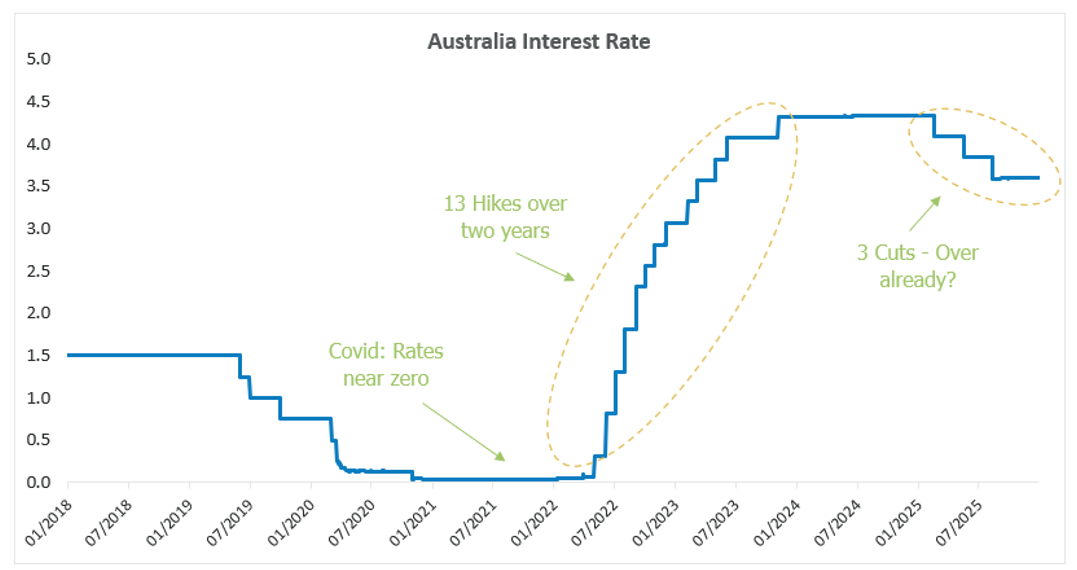

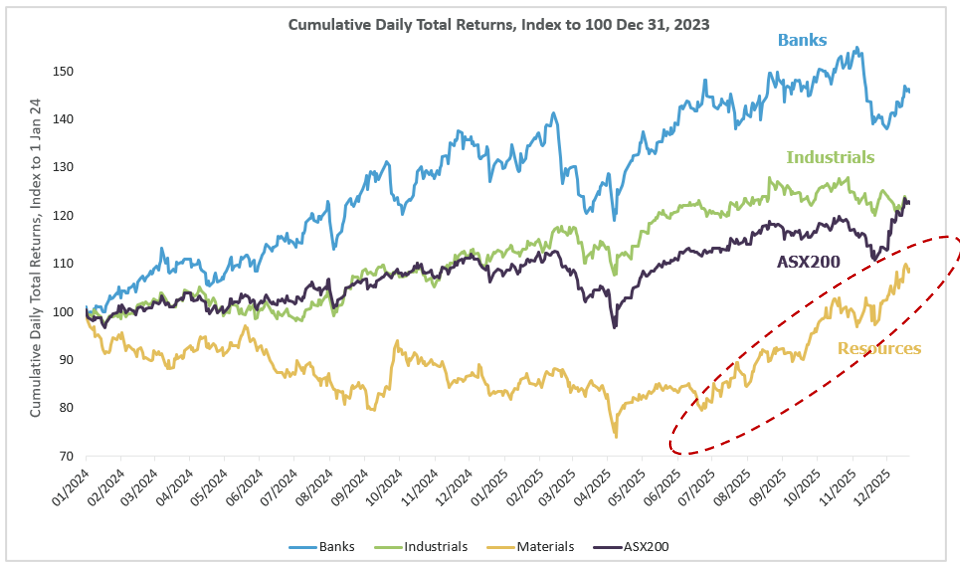

The Australian market proved remarkably resilient in 2025, shrugging off early concerns around Trump tariffs and late-year anxieties over AI capital expenditure returns. What truly set Australia apart was its strategic exposure to the commodities that mattered most—precious metals like gold and silver surged as safe-haven demand intensified, while transition metals including copper, aluminium and lithium benefited from the infrastructure build-out underpinning the AI revolution and energy transition. Rates dominated the policy narrative in unexpected ways. The RBA’s trajectory evolved from a rate-cutting stance early in the year to a hold position from August, before ultimately signalling an increasing probability of rate hikes heading into 2026. This shifting stance pressured rate-sensitive sectors including consumer discretionary, technology and property trusts, establishing a debate that will remain central through the year ahead.

Source: Bloomberg, 14 January 2026

Resources delivered the most striking narrative of 2025. After years of downgrades and investor scepticism, the materials sector staged a spectacular comeback, delivering returns exceeding 30%. The rally unfolded in waves: gold continued its rally yet accelerated towards the end of the year, as it broadened initial gains came from more leveraged single stock exposures before extending to the large-cap diversified miners. The question now is whether this rotational momentum can be sustained.

Source: Bloomberg, 31 December 2025

Looking Ahead to 2026: Earnings, Expansion and Execution

We enter 2026 with genuine conviction, though acutely aware that market conditions can pivot quickly. The first half of the year presents particularly promising conditions across three critical dimensions:

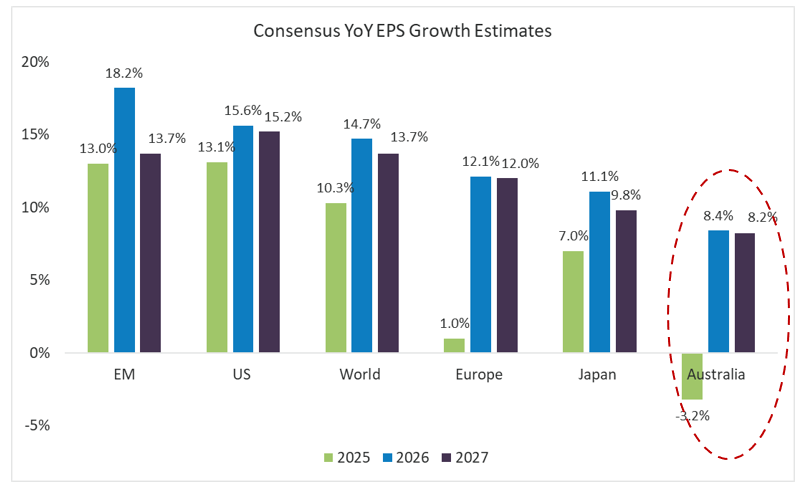

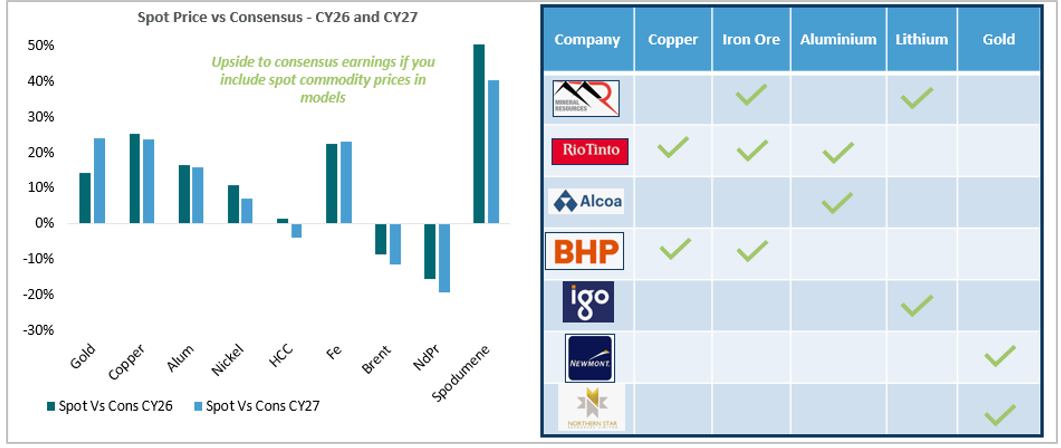

Earnings: A Return to Growth: Australian earnings are poised to deliver positive growth for the first time in three years, with resources leading the charge. The earnings leadership rotation toward Metals & Mining appears durable, underpinned by a potent combination of better-than-feared global demand, ongoing supply constraints, a weakening US dollar, and crucially, conservative sell-side commodity price assumptions. This creates fertile ground for continued earnings upgrades and presents potential upside to the Australian earnings growth forecasts presented below.

Source: Bloomberg, 12 January 2026

Expansion: Multiple Growth Vectors: We anticipate expansion across multiple fronts. Domestically, economic growth remains robust and resilient, capital expenditure is lifting, the commodity rally shows signs of extending. Globally, the picture is similarly constructive: further Federal Reserve rate cuts are expected, US President Trump’s “One Big Beautiful Bill” should deliver meaningful tax relief, private sector job growth is stabilising, AI capital expenditure continues its steep ascent—with efficiency gains hopefully beginning to materialise—and a tariff détente with China would provide welcome breathing room for global trade.

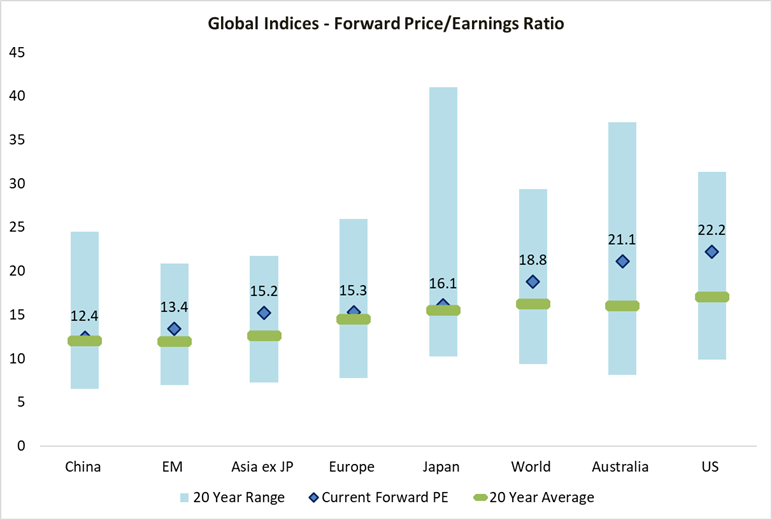

Execution: Separating Winners from Laggards: With markets trading at elevated valuations, the bar is high. Management execution to deliver earnings growth becomes paramount to validate higher valuations. AI infrastructure spending must demonstrate tangible returns, miners need to deliver on production targets and cost guidance, and corporates across the board will need to navigate heightened geopolitical uncertainty and an unpredictable Trump administration—particularly as pressure builds ahead of the October US mid-term elections. In a market priced for success, execution quality will separate the winners from the disappointments.

Source: Alphinity, Bloomberg, 12 January 2026

Portfolio Positioning: Leaning Into the Cyclical Upswing

This constructive but nuanced outlook has driven us toward higher cyclical exposure across our Australian strategies, reflecting our confidence in broader and more sustained earnings revisions within the metals and mining sector. Three areas highlight our positioning:

Resources are set to shine: Consistent with the earnings leadership shift toward Metals & Mining and our positive view on its sustainability, we are entering 2026 with substantial exposure to resources. We favour transition metals, such as copper, aluminium and lithium, given the outlook for further earnings upgrades driven by better-than-feared global demand, ongoing supply constraints, a weakening US dollar, and crucially, conservative sell-side commodity price assumptions. We are overweight a mix of single-commodity producers, such as Mineral Resources, Alcoa and IGO, and diversified miners, including both BHP and RIO. In addition, we maintain our exposure to iron ore as we believe the market is tighter than generally appreciated and remain relatively neutral gold, through producers such as Newmont and Northern Star, given the strength in the gold price driven by increased central bank buying and its safe haven status amid an uncertain geopolitical outlook.

Source: Alphinity, Bloomberg, 12 January 2026

Banks offer earnings strength beyond the rally: Despite the substantial outperformance of banks since early 2024, we believe the sector still has further to run. Earnings upgrades continue to be driven by exceptionally benign credit conditions—low bad debt expenses and ongoing provision releases—alongside healthy mid-to-high single-digit volume growth and well-controlled cost growth delivering modest pre-provision profit expansion. The sector benefits from stable structural fundamentals: strong capital and provisioning buffers, no competitive disruption on the horizon, and a very mild credit cycle with no earnings cliff in sight. While valuations now appear stretched on most measures, banks ex-CBA look considerably more attractive, justifying our selective approach and ongoing preference for NAB and Westpac.

Source: Barrenjoey, Alphinity, 31 December 2025

Consumer selectivity is essential: The broader consumer environment remains resilient despite slow growth, with ongoing focus on value and promotions. Australian consumer confidence has softened recently on weaker job confidence and renewed rate rise expectations. Against this backdrop, we favour domestic retailers offering strong value and/or exposure to the undersupplied housing market, while avoiding US discretionary names given persistent pressure on lower- and middle-income consumers.

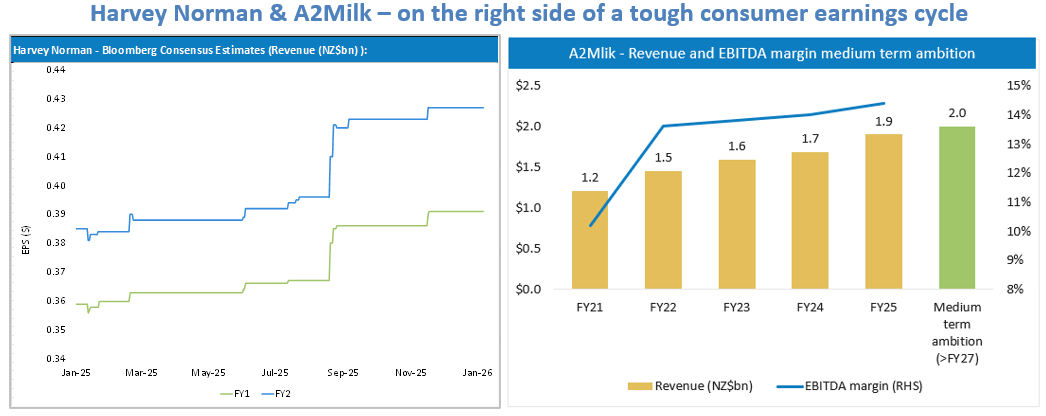

Within Staples, we are underweight supermarkets due to intense competitive dynamics as traditional players lose share to new entrants, raising the risk of a margin-damaging price war. We also avoid alcohol given company-specific challenges compounded by what appears to be structural volume decline. By contrast, Harvey Norman and A2 Milk remain our preferred consumer plays, both offering structural tailwinds and clearer paths to earnings growth.

Harvey Norman stands out as a clear earnings outperformer amongst the discretionary names, driven by resilient consumer electronics demand, regained market share, and strong operating leverage. Its broad product range—spanning furniture, appliances, and home fittings—positions it to benefit from a housing and consumer confidence recovery. International operations, particularly the improving UK business, add further potential upside to margins and group profits, supporting continued earnings momentum into 1H26 and beyond.

A2 Milk remains our preferred pick among defensive consumer staples. Positive earnings momentum should continue, led by strong growth in China’s infant milk formula segment, particularly through share gains in the English Label business and the launch of the higher priced HMO Genesis product. Over the longer term, vertical integration of the Pokeno plant will enable new China Label products, supporting further share gains and margin expansion. Losses in the US are expected to narrow over time, while A2M’s strong cash position provides capacity for future shareholder returns once the Pokeno acquisition is complete.

Source: LHS: Alphinity, Bloomberg, 14 January 2026. RHS: A2M Financial results, Aug 2025.

The year ahead will be defined by our three Es: Earnings momentum must broaden beyond resources, Expansion needs to materialise across both domestic and global fronts, and management Execution will separate winners from disappointments in a market priced for success. Key watchpoints remain the sustainability of the commodity rally, the RBA’s policy trajectory, and whether earnings upgrades can extend beyond the materials sector. In this environment, selectivity matters—backing companies with genuine earnings momentum, structural tailwinds, and proven management teams will be essential to navigating 2026’s opportunities and risks.