Apollo on stagflation, private credit strength, and the coming AI infrastructure wave

The following was published by Livewire on 19 May 2025.

Apollo’s Matt O’Mara on stagflation, private credit, and why AI, energy and infrastructure will need billions in capital.

Investors at leading alternative asset manager Apollo are closely monitoring the impact of tariff policies and preparing for a prolonged period of higher interest rates and slower growth.

In this environment, Matt O’Mara, Partner and Co-Head of Apollo Aligned Alternatives, expects high-quality private credit to hold up well.

The outlook for private equity, however, is more mixed, with highly leveraged and growth-focused investments likely to face headwinds.

O’Mara says Apollo has been anticipating this scenario for some time, and recent policy shifts have only reinforced those views, creating substantial uncertainty for companies and their investment decisions.

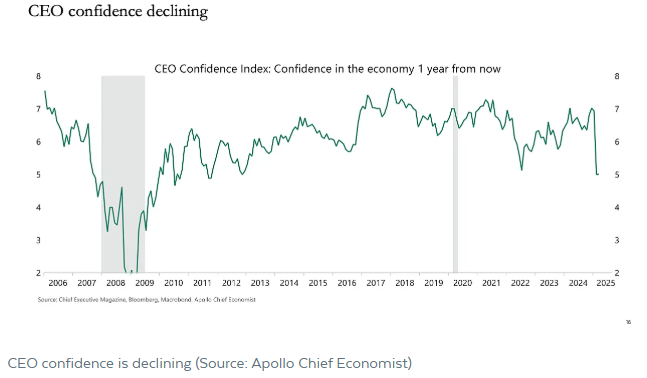

“We're lucky at Apollo to have a real economic thought leader in our chief economist, Torsten Slok,” he says. “He's been at the forefront - and really right - on a lot of these things. The internal view, and the data we’re getting from him, shows that hard data has really started to slow down.”

“Shipping volumes have completely collapsed. The market has priced in a 40% probability of recession. Internally, we think it’s probably a bit higher.”

Apollo is keeping a close eye on opportunities to deploy capital should a reshoring trend gather momentum in the United States. But O’Mara says the policy environment remains too volatile for companies to commit to major capital expenditure just yet.

“Policy has been volatile, and I don't think we really know where it lands yet. Companies aren't yet pursuing large capex programs in response to it.”

Long-term capital mismatch

Despite near-term volatility, O’Mara points to several long-term structural thematics that continue to offer compelling opportunities for Apollo. He highlights infrastructure, energy, and the rollout of artificial intelligence as key areas where there's a clear mismatch between the supply and demand of capital.

“We continue to believe that there's going to be billions of dollars required to upgrade infrastructure,” he says. “As AI becomes more prevalent, data centres are going to keep popping up, and they’re huge consumers of power. Whether it’s building the data centre, financing it, or developing the energy infrastructure that powers it, all of that requires capital.”

While tariffs and policy volatility may cause short-term disruption, O’Mara is confident these themes have global reach and staying power.

“AI isn’t a U.S. thing or an Australian thing - it’s a global thing. All AI needs robust data centres, and all data centres need serious power. These are global phenomena, and we think they’ll be sources of opportunity for years to come.”

Keeping a steady hand

Apollo invests across private credit, private equity, and hybrid strategies, with 80% of the firm’s investments currently in private credit. In uncertain times, O’Mara says the focus is on maintaining discipline and positioning portfolios for resilience.

“It’s about being good partners, staying active in deployment, moving up in quality, and expanding our client base while others are pulling back.”

Public market credit has experienced bouts of volatility, but the effects tend to reach private markets more slowly. While higher rates are increasing the cost of capital, O’Mara believes the high-quality companies Apollo backs are best placed to weather these conditions.

On the private equity and hybrid side of the business, the firm is staying patient, but ready to act when attractive opportunities emerge. The private equity boom of the 2010s is still playing out - and with that, Apollo sees areas to lean in.

“A lot of private equity deals done in the 2010s, especially before rates spiked in 2022, were struck at high valuations and financed with cheap debt. Now, many private equity firms are struggling with those portfolios, particularly given the volatile IPO markets.”

Through its hybrid strategies, Apollo is providing extension capital to these firms, support that offers downside protection along with potential for upside.

Seeking to provide excess return along the risk-reward spectrum

Founded in 1990, Apollo is a high-growth alternative asset management and retirement services firm. Apollo seeks to provide its clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three business strategies: equity, hybrid, and yield.

Apollo Management Singapore Pte Ltd (ARBN 635 094 914) (“Apollo Singapore”) is exempt under ASIC class order 03/1102 from the requirement to hold an Australian Financial Services Licence in respect of the financial services being provided in this jurisdiction to wholesale clients. Apollo Singapore is regulated by the Monetary Authority of Singapore under Singapore laws, which differ from Australian laws. The information in relation to this material has been provided by Apollo, including any statements of opinion. The information in this material is general information only and is intended solely for licensed financial advisers or authorised representatives of licensed financial advisers and wholesale investors. It is not intended to constitute financial product advice or an offer, invitation, solicitation or recommendation to invest. This information must not be distributed, delivered, disclosed or otherwise disseminated to any investor. It has been prepared without taking into account any person’s investment objectives, financial situation or needs. Investors should consider whether the information is suitable to their circumstances.

Livewire gives readers access to information and educational content provided by financial services professionals and companies ("Livewire Contributors"). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.