Ox on the Ground: Vietnam’s Accelerating Transformation

Vietnam is rapidly positioning itself as a leading growth market in Asia, fuelled by sweeping policy reforms, unprecedented infrastructure investment, and a young, digitally driven population. During our recent visit to Ho Chi Minh City, the optimism was palpable - policy shifts are unlocking private sector momentum, modernising industries, and fuelling a new wave of growth.

Infrastructure Boom

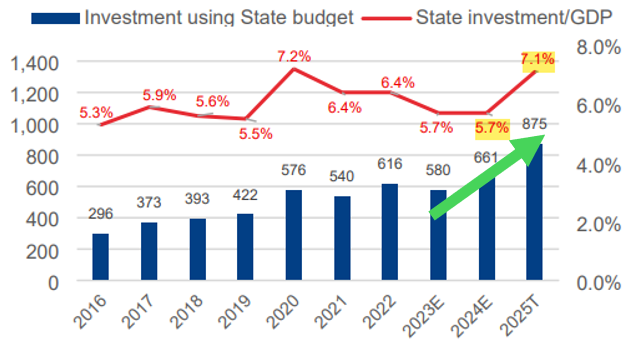

Vietnam is supercharging infrastructure investment to drive long-term, broad-based growth. Under its recent government Resolution 154 and with an ambitious 8%+ GDP growth target for 2025, public investment will jump from under 6% to over 7% of GDP in 2025 - a surge of more than 30% year-on-year. Over 80% of this capital is targeted at transformative projects, including 1,188 km of new expressways set for completion this year - expanding the highway network by nearly 50% just this year, slashing logistics costs, and opening new economic corridors. Major upgrades to railways, ports, airports, and power networks are also underway, laying the groundwork for Vietnam’s next era of economic expansion.

Vietnam’s Public Investment Budget growing to Record Highs

Source: GSO, CEIC, HSC Research

Landmark projects are now coming online, signalling a real shift in Vietnam’s infrastructure landscape. The completion of Ho Chi Minh City’s first metro line marks the beginning of a transformation in urban mobility for the city’s more than 10 million residents, while the rollout of major expressway and airport expansions is set to further boost connectivity nationwide.

Ox on the Ground: HCMC’s Metro - A Glimpse of Vietnam’s Urban Future

|  |

Source: Ox Capital

Looking ahead, Vietnam aims to double its expressway network to 5,000 km by 2030, accelerate planning of a high-speed North-South railway, modernise key ports and airports, and upgrade urban transit and inland waterways - initiatives that will underpin productivity gains and sustain the country’s next phase of economic growth.

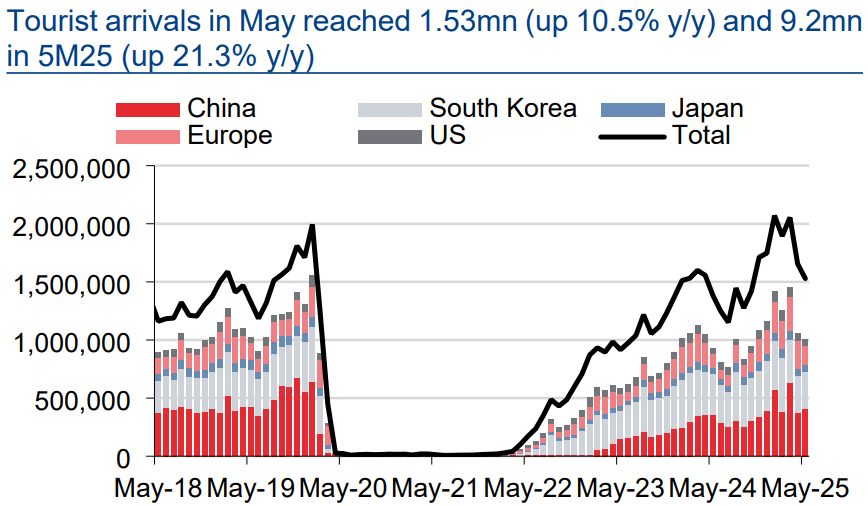

On the Ground: Airports Are Bustling and Ripe for Expansion as Tourism Passes Pre-Pandemic Highs

|  |

Source: Ox Capital, HSC Research, NSO & CEIC

Private Sector Momentum

On the ground in Vietnam, there was a clear sense of renewed optimism about the country’s next stage of growth, even with uncertainty over how its tariffs compare to those of other key Asian export countries. It was clear that Vietnam is entering a new phase of structural reform, with the government actively positioning the private sector as the economy’s primary growth engine.

Ambitious policies are being introduced to propel private enterprise to outpace overall GDP growth - targeting 10 -12% annual expansion for private companies versus the 8% national goal for GDP growth. Core measures, including Resolution 68’s 30% reduction in licensing barriers by 2025 and the decentralization of decision-making through Resolutions 198 and 65, will streamline approvals and cut inefficiency, making it materially easier and more cost-effective for businesses to launch and scale.

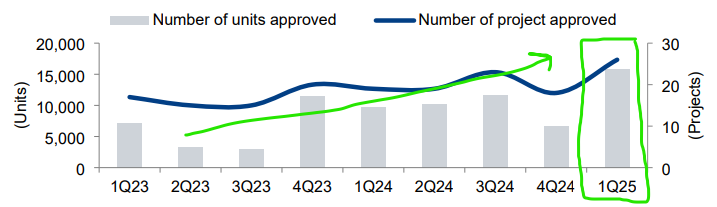

Our discussions with high quality portfolio company Nam Long (HOSE: NLG) in HCMC confirmed that these reforms, some introduced only weeks before our visit, are already translating into faster project approvals and can support accelerated earnings realisation. Confidence in real estate investment is returning, with 1H25 project take-up rates rebounding to higher levels not since before the pandemic.

Project approvals surged 250% QoQ and 150% YoY in 1Q25, with NLG confirming the momentum is still building!

Source: MOC, HSC Research

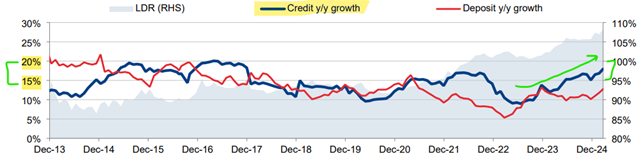

Complemented by a >16% credit growth target for 2025 and easier credit conditions, these changes are unlocking capital and supporting renewed confidence in sectors like real estate. Collectively, these reforms are set to elevate the private sector from a supporting role to the driving force behind Vietnam’s economic growth.

System credit growth was up over 18% YoY in 1Q25 and still accelerating

Source: SBV, HSC Research

Retail Revolution

Stronger private sector momentum and improved credit conditions are also fuelling the continued development of Vietnam’s retail landscape. A busy visit to a Phu Nhuan Jewelry (HOSE: PNJ) store on a Friday afternoon says it all: easier credit is powering consumption growth, with private consumption accounting for 54% of GDP in 2024 in Vietnam.

Cheaper loans and rising consumer confidence mean more shoppers can spend on higher-quality goods and services. As shareholders, we see firsthand how PNJ’s upscale, modern stores and lively customer interactions capture Vietnam’s shift toward premium, experience-driven retail, as consumers become more discerning and seek elevated shopping experiences.

On the Ground: Experiencing Vietnam’s New Standard for Premium, Aspirational Retail at PNJ

|  |

Source: Ox Capital

A visit to Mobile World Group’s (HOSE: MWG) Bách Hóa Xanh (BHX) grocery stores revealed similarly solid consumption momentum. Busy aisles and active shoppers highlight how modern grocery formats are capturing Vietnam’s rising demand, as consumers increasingly graduate from traditional wet markets to air-conditioned, well-stocked stores.

On the Ground: BHX Stores Lead Vietnam’s Grocery Transformation

|  |

Source: Ox Capital

Digital Leap

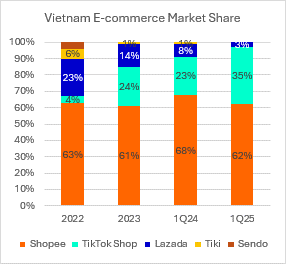

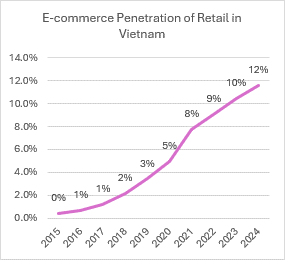

Vietnam’s e-commerce market has surged from virtually zero to 12% of retail sales in just a decade, powered by a strong base of digitally savvy consumers and relentless platform innovation. Shopee, operated by our portfolio company Sea Limited, commands over 60% market share, even as TikTok Shop’s rapid rise since 2022 has formed a virtual duopoly.

Vietnam’s E-Commerce Takeoff: Explosive Growth and Market Consolidation

|  |

Source: Left - BofA Research and Momentum Works (2022, 2023 GMV data), VnEconomy.VN and Metric.VN (2024, 2025 GMV data). Right - Bernstein Estimates.

What truly distinguishes Vietnam is its growth-driven, digitally adept seller base - more reminiscent of China than regional peers - who actively invest in advertising and technology to drive sales. This unique blend of sophisticated consumer demand, robust digital infrastructure, and platform-led innovation positions Sea Limited to capitalise on one of the world’s fastest-growing and most dynamic e-commerce markets.

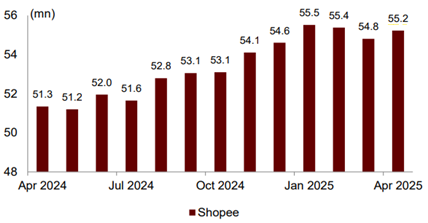

Over 50% of the 100M population is a monthly active user of Shopee in Vietnam!

Source: data.ai, CICC Research

Shopee’s scale and strategic partnerships - such as integrating VinFast EVs and smart lockers - reinforce its cost leadership in e-commerce logistics, enabling reinvestment to deepen its ecosystem and elevate the customer experience. Backed by pro-growth reforms and digital infrastructure investment, this ecosystem-driven model is fuelling innovation and sustaining Vietnam’s dynamic retail expansion.

On the Ground: Shopee’s branding and VinFast’s EVs dominate the urban landscape.

|  |

Source: Ox Capital

ESG & Sustainability

Ox also attended the 2025 Vietnam ESG Investor Conference in HCMC, hosted by Australia’s Department of Foreign Affairs. The event underscored Vietnam’s emergence as a market where sustainability and growth are increasingly intertwined. Policy reforms, green infrastructure, and innovative financing are creating real opportunities for long-term, ESG-focused investors. With its strategic role in global supply chains, young workforce, and accelerating investment in clean energy, Vietnam is well positioned as a leading destination for responsible, sustainable capital - an outlook that aligns with Ox Capital’s commitment to investing in the country’s future leading companies.

On the Ground: 2025 ESG Investor Conference highlighted the convergence of growth and sustainability.

Source: Raise Partners and Vietnam Innovators Digest. Left to right: Kate Goodwin (Ox Capital), Van Ly (Raise Partners Vietnam), Ben Lindsay (Investible)

Vietnam’s transformation is unfolding now, with reforms and investment fuelling broad-based momentum. For investors, the opportunities are as dynamic as the optimism on the ground - Vietnam is fast becoming one of Asia’s most compelling growth stories. Ox Capital is committed to identifying and backing the future champions emerging from this dynamic market.

Important Information

This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia.

This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.

This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.