Why investors who ignore private markets are missing out

Private markets, referring to investments that are not publicly traded, have seen significant growth in recent years and are now increasingly accessible to individual investors. As discussed in our Private Markets Primer, there are many benefits to private market investment, including low correlation to traditional assets, reduced volatility, portfolio diversification, and an attractive illiquidity premium that helps to boost returns for private investments.

Investors without exposure to private markets are missing out on not only attractive returns but important diversification opportunities for their portfolios. Given the nature of today’s market environment, those investors are also putting themselves at risk of high levels of market concentration. Nevertheless, investors should be aware of the risks of private markets, including lower liquidity and reduced transparency. It is important to appropriately consider each investment type and manager.

Missing out on: Growth opportunities in equities

Investors who ignore private markets are missing out on important growth opportunities only available in private markets. The number of stocks listed on public equity markets has fallen significantly in recent decades; in the US, the number of publicly traded firms peaked at over 7000 in 1996 versus around 4000 today1. Similarly in the UK the LSE has lost a quarter of its companies in the last decade2. In Australia, number of IPOs are at their lowest level in over a decade3, and this is echoed in many developed markets around the globe including the US.

These figures reflect the trend of companies staying private for longer. A decade ago, companies took an average of 6.9 years to go public; that has increased to 10.7 years now4. There are a number of reasons companies choose to remain private, including burdensome and costly regulatory requirements for public companies, excessive short-term performance pressures from public shareholders, complex disclosure rules and the high cost of an IPO. Furthermore, reduced regulatory barriers in private markets in recent decades mean there are many more private financing alternatives available to companies now. As a result, many companies are staying private until they have higher valuations than in the past, demonstrated by the increasing number of “unicorns” (VC-backed companies with valuations of US$1bn+). More and more of a company’s growth is now achieved during the private financing period, meaning those investors who only participate in public financings are missing out on a large proportion of returns.

Missing out on: Diversification opportunities in equities

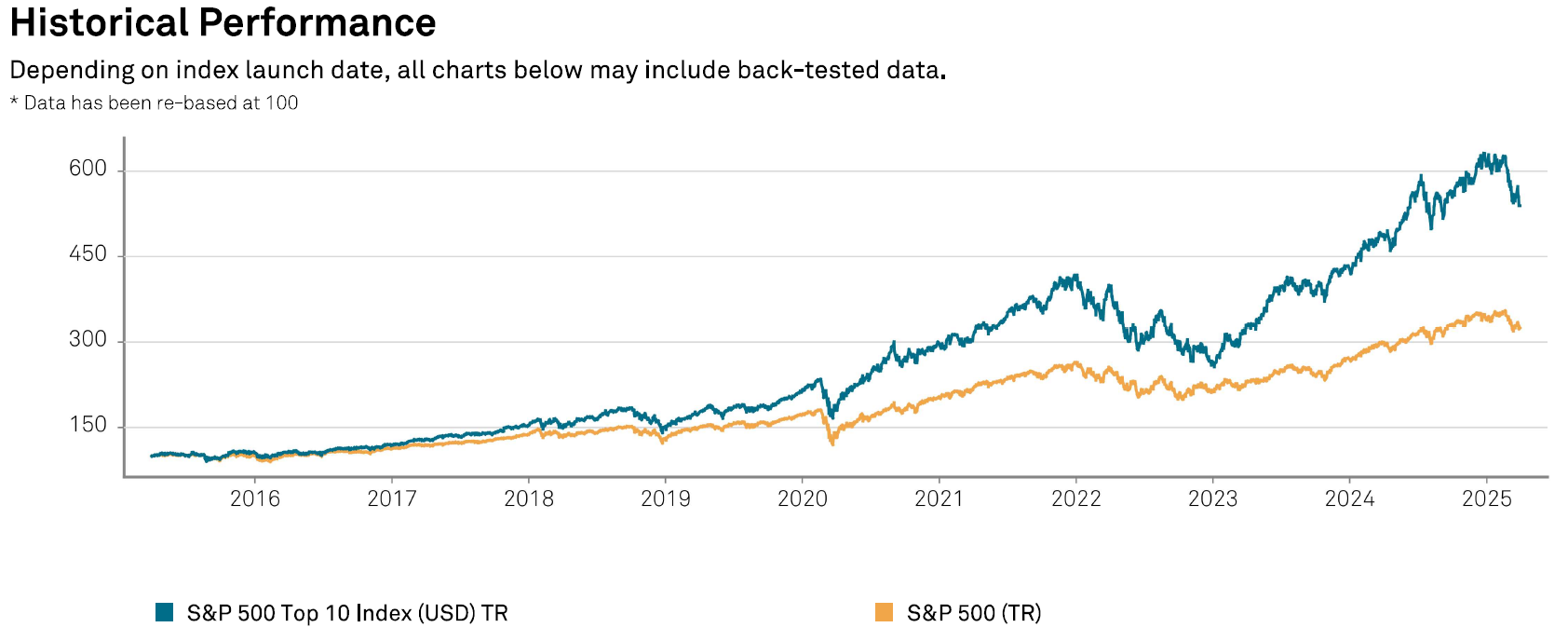

Investors exposed exclusively to public markets are limiting themselves from accessing the significant diversification opportunities available through private market investment. Public equity market indices have become increasingly concentrated, with performance of many developed market indices dominated by a few stocks and sectors. The top 10 stocks in the S&P 500 Index made up 34% of the index market capitalisation as at 31 March 2025 . Since 2023, S&P 500 performance has been driven markedly by these top 10 stocks, and index returns remain heavily dependent on the prospects of a relatively small number of companies.

Historical performance of S&P 500 Top 10 Index (USD) TR vs S&P 500 (TR)

Source: S&;P Dow Jones Indices as at 31 March 2025.

Australian public equity markets present a similar picture, with the top 10 stocks representing over 40% of the S&P/ASX 200 Index as at 31 March 2025 . In addition to this concentration in a handful of stocks, there is significant sector concentration within the Australian market. Index sector exposure is heavily weighted to financial, materials and industrials, making for a highly cyclical market sensitive to economic shocks.

The consequence of significant concentration in public equity markets is that investor portfolios are vulnerable to large volatility shocks if those stocks and sectors are impacted by negative news.

Private equity markets, by contrast, are much broader and see far less concentration. 87% of US firms with revenue greater than $100 million are private , representing over 18,000 private companies compared with just 2,800 public companies of that size . Investing in private equity unlocks access to a far more diverse range of companies in sectors underrepresented in public markets, creating more resilient portfolios.

Missing out on: Diversification opportunities in fixed income

The issue of concentration in public markets is not unique to equities; concentration in public bond markets is also significant, particularly in Australia, restricting the potential breadth of fixed income portfolios. The Australian (AUD denominated) public bond market, outside of government-issued securities, is relatively narrow and is dominated by issuers in the financial, industrial and utilities sectors. In contrast, private credit offers investors the opportunity to gain exposure to diverse industry sectors through loans to small and medium enterprises and middle market companies that cannot issue in public markets. Sectors serviced by private lending markets include healthcare, pharmaceuticals, retail, food and beverage, education services, aerospace and defence and information technology.

Furthermore, Australia lacks a developed corporate high yield market with the Australian public bond market limited to mostly investment grade securities. Private credit offers greater diversity of credit ratings, including a broad variety of high yield borrowers, allowing for investors to better meet their risk-return requirements and cater to those looking for a higher return.

Conclusion

Private markets can offer meaningful benefits for investors which cannot be achieved through public markets. Those who choose to ignore private markets are missing out on significant opportunities for growth and diversification and leaving portfolios vulnerable to the risks of concentration in public markets. However, it’s important to recognise that private market investments could include higher risks, such as limited liquidity and reduced transparency. Investors should consider the advantages and risks of private market investments when seeking to enhance their portfolios and achieve more resilient, diversified, and potentially higher returns.

[1] Source: CNN, April 2024 https://edition.cnn.com/2024/04/09/investing/premarket-stocks-trading/index.html [2] Source: Bloomberg, December 2024 https://www.bloomberg.com/news/newsletters/2024-12-04/bargain-britain-s-stock-market-is-shrinking-fast [3] Source: ASIC, February 2025 https://download.asic.gov.au/media/44hh5ctv/australia-s-evolving-capital-markets-a-discussion-paper-on-the-dynamics-between-public-and-private-markets.pdf [4] Source: Morningstar, January 2025 https://indexes.morningstar.com/insights/analysis/blt81d5614b4c2ccd2b/unicorns-and-the-growth-of-private-markets [5] Source: Bloomberg [6] Source: Bloomberg [7] Source: Apollo, April 2024 https://www.apolloacademy.com/many-more-private-firms-in-the-us/#:~:text=In%20financial%20markets%2C%20a%20lot,then%20%24100%20million%20by%20count. [8] Source: Hamilton Lane, April 2022 https://www.hamiltonlane.com/en-us/insight/staying-private-longer

This material has been prepared by Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante). Fidante is the holder of an Australian Financial Services Licence and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe for interests, and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither Fidante nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.