FED up

Kapstream Capital

‘Fed Up’ is a 2014 documentary about the food industry and how ‘Big Sugar’ (amongst others) are responsible for the ill health of everyday Americans. Today’s reference of course is to the US Federal Reserve and central banks globally, where distinct parallels exist given their constant sweetening (through low rates/QE) of markets and where any sign of a tantrum (heightened volatility/drawdown) is met with more ‘sugar’ – larger policy responses to each new crisis. This has created a generation of ‘financial consumers’ gorging on cheap debt. Yet promises that the feasting can continue into perpetuity, simply cannot be kept.

Fixed income investors face a particularly challenging time, as uncertainty over global economic recovery and monetary policy entwine. Guiding investors on this journey falls in part to the (hopefully) steady hand of those in charge at the central banks, as they seek to sustain momentum of the post-pandemic economic reopening, without allowing inflation to get out of hand. It’s a delicate balance adjusting the lever of QE, and it’s no wonder bond markets are struggling to fully interpret the implications. For investors, the double whammy is that it comes at a time when fixed income returns are generally pedestrian at best, QE having kept real yields depressed for years.

The question of how persistent and at what level inflation remains is almost impossible to answer. Are we seeing reasonably constant improvement in economic data? Yes. Rising confidence in coronavirus vaccine success? Yes [noting the recent South African strain]. Border reopening plans coming closer? Yes. But also impacting the pace of inflation are supply chain disruptions and knock-on impact to the costs of goods and services. If we assume these issues resolve over time, as the world continues to emerge from the restrictions faced and prices moderate, inflation becomes more manageable. So eaaasy does it, please guv’nor…

What have we seen so far? Recent bond price action was driven by a sharp sell-off (higher yields, lower prices) across developed market curves, particularly in the front end. This was caused by markets hurriedly re-pricing rate hike expectations to be sooner than expected due to inflation, which is proving more persistent than anticipated.

The fiercest moves occurred close to home, with the Reserve Bank of Australia’s policy of Yield Curve Control (‘YCC’, which targeted 0.10% yields in the 3yr and below part of the curve) being challenged by market participants. In late October, the April ‘24 bond traded as high as 0.18%. The RBA subsequently bought AUD1bn of bonds, bringing the yield closer to target at 0.115%. However, at the end of the month Core CPI printed at 2.1% annualised, within the RBA’s target range for the first time since 2015, and yields on the April ‘24 bond climbed again to 0.2%. The following day there was anticipation the RBA would be back in the market, purchasing bonds, to draw the yield closer to target once more. But no RBA and no communications. Over the next few trading sessions, yields on the April ‘24 bond climbed as high as 0.8%, suggesting YCC would be abandoned at the upcoming RBA meeting. Indeed in early November that’s exactly what transpired. The 3yr bond soared 91 basis points to 1.22%, while the 10yr rose 60 basis points to 2.09%.

We’re taught that central bank policy drives markets, but increasingly it seems it is the other way around as markets have begun to challenge the ultra-accommodative stance of central banks. The RBA’s loss of its YCC target is one example. As we turn our attention to the US and the Federal Reserve, could the suspicious observer suggest that the Fed is ‘on hold’ until the market forces its hand?

Key economic data in the US (such as lower unemployment and lower underemployment) provided a tailwind to the inflation story, with QE tapering anticipated in the near term, and bond yields pushing higher there also. Let’s not forget that in the last cycle, the Fed began to normalise its balance sheet and embark on a rate hiking cycle when i) inflation was lower, ii) unemployment was higher and iii) the tailwind of asset returns, while still positive, was softer. Why should central banks maintain emergency level policy settings? Interest rates will continue to rise in 2022.

But rather than fretting over a half-empty plate, investors should keep in mind that rising rates are not necessarily a bad development. For over a decade, we’ve all moaned about astonishingly low bond yields. Important at this juncture is the pace of rises which will dictate the trajectory of bond returns. Without short term surprise (please central bank Chairs and Governors, take note) investors have the opportunity to reinvest maturing securities at yields higher than what had been available only weeks or months prior. This strategy is all the more relevant for strategies (such as ours) biased to shorter-dated assets that can exit highly liquid positions and reallocate towards longer-dated, higher-yielding securities of similar quality. If inflation proves more persistent than expected but policy rates remain on hold, shorter-dated strategies are also less impacted by rising rates than those that have extended duration profiles.

It’s our job to insulate investors as best we can from the continuing uncertainty. Step one. Buy high-quality, shorter-dated bonds – noting the relatively higher yields available now as a result of the calendar-year-to-date volatility – exhibiting the best risk/reward profile that we can find globally to drive a robust and absolute income stream. Step two. Use hedging techniques – or think of it as portfolio insurance – to neutralise the risks that an uncertain interest rate and inflation environment present.

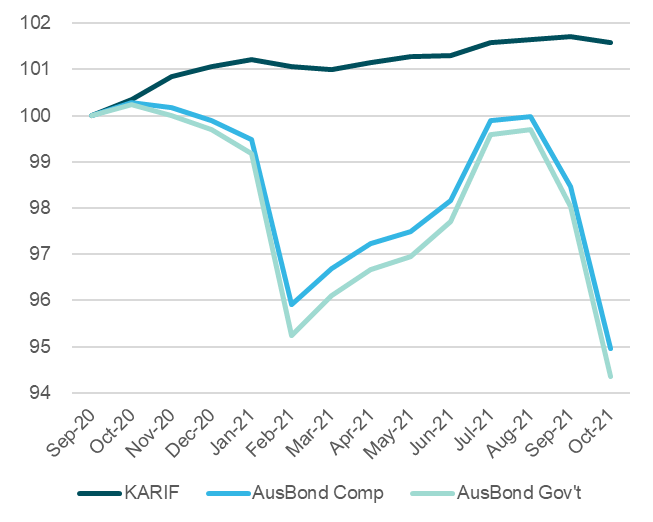

Our objective is never to ‘shoot the lights out’ but simply to ‘keep the lights on’, and to highlight this, the chart below compares the gross return of our flagship Kapstream Absolute Return Income Fund (‘KARIF’) against a couple of widely used local bond benchmarks, the AusBond Composite and AusBond Government indices, over the past 12 months:

It’s clear in the above chart how an environment characterised by interest rate uncertainty and volatility can impact bond markets. Conventionally-managed portfolios have struggled to maintain their defensive attributes for investors; performance has been fairly wild and low yields have been insufficient to offset the impacts of rate moves, quickly eroding capital and driving more traditional portfolios to not immaterial losses in the 3-5% range.

COVID-19 and potential new waves or new strains will remain a cloud hanging over investors’ minds until vaccination and efficacy rates are meaningfully higher. We are beyond the peak in fiscal stimulus with governments satisfied they were able to avoid a materially longer and deeper period of low growth. Central banks now have the unenviable task of managing the removal of ‘candy’ from outstretched hands, do they continue to do so slowly, or does inflation force faster ‘dieting’. If it’s the latter, what new tantrums are around the corner? Hopefully the only upset will be among the ungrateful kids spitting the Christmas dummy as supply chain constraints impact delivery of this years ‘must have’ new toys. Just give ‘em sugar…